The elusive “Infrastructure Week” has finally been realized with the passage of H.R. 3685, a US$1.2 trillion infrastructure bill that includes US$550 billion in new spending. For water, this is a significant FIRST step to tackle some age-old problems like water quality and aging infrastructure, in addition to the mounting concerns over climate. Given that the funding will be rolled out over five years, this allows critical stakeholders to focus on projects of need rather than those that are “shovel ready”.

The US$55 billion of funding for water & wastewater infrastructure focuses largely on municipal improvements to safe drinking water and sanitation services, yet a notable shift to big picture issues is evident. Key allocations for climate resiliency and cybersecurity showcase a more forward-looking perspective. Still, this is only the beginning of the funding actually needed to address the water sector’s needs. Earlier this year, Bluefield helped the American Society of Civil Engineers grade this country’s drinking water, wastewater, and stormwater infrastructure sectors, which all received poor marks of C-, D+, and D, respectively.

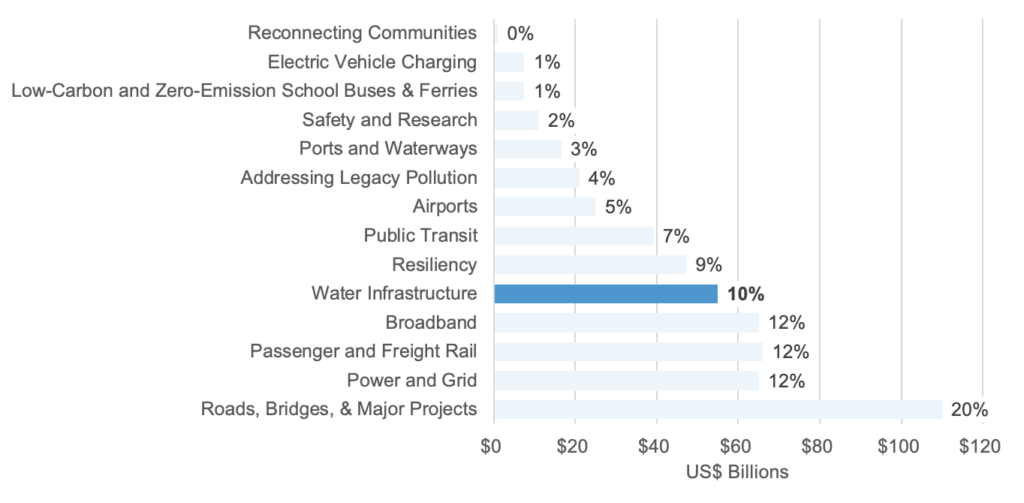

With 10% of funding dedicated to water, this landmark bill shows how far the water industry has come by securing a seat the proverbial infrastructure table. It also highlights how much further we need to go to capture the investment of other sectors including energy, cable, and transportation.

Breakdown of Funding by Industry

Source: Congressional Research Service, Bluefield Research

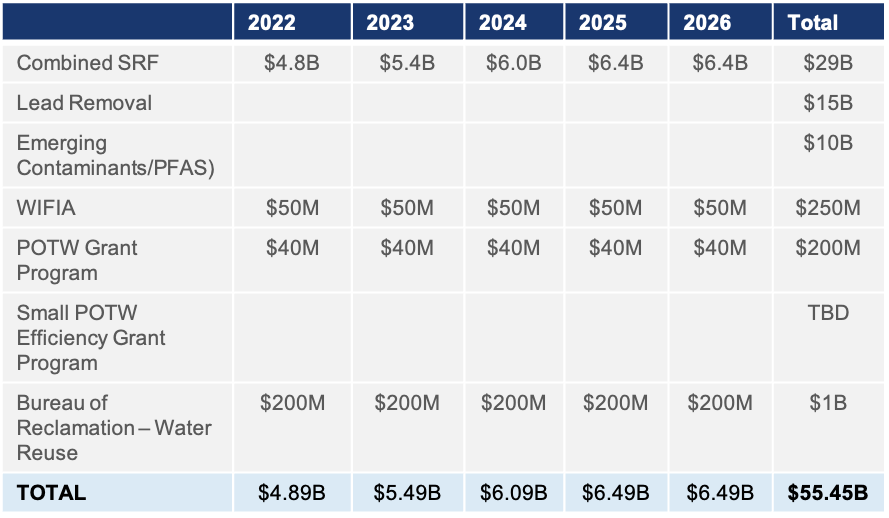

Select IIJA Water Infrastructure Spending Categories

Source: Congressional Research Service, Bluefield Research

Key takeaways from Bluefield’s team:

Water quality actions move to the forefront… after decades. Still US$17 billion short of Bluefield’s estimate of the US$32+ billion needed to fully get the job done, the US$15 billion allocation for lead replacement is this country’s largest investment in clean water to date. At the forefront of this market opportunity are emerging digital solutions firms and engineering firms positioning to efficiently inventory the full extent of the problem at a ground level. Thereafter, plumbers and local contractors will be able to close the deal on replacing millions of the nation’s pipes, joints, and connections. The rollout for these activities is already taking shape in places like New Jersey, where policymakers are accelerating their own initiatives of mitigation actions to address lead tainted drinking water.

Another US$4 billion is slated to address water contamination from per- and polyfluoroalkyl substances (PFAS). This emerging contaminant has rapidly risen to the top of the list for environmental regulators. Another US$1 billion over five years will be provided to the state revolving fund program as loans with 100% forgiveness, or as grants.

Key channel for distribution via SRF makes the most sense. The well-established State Revolving Fund (SRF) program is the primary means by which the federal and state governments provide financial support to water & wastewater infrastructure projects and the new infrastructure investment plan further cements the program’s role. Since 2000, these critical sources of capital via loans and grants have made up an average of 14.4%, or US$7.7 billion, of annual capital expenditures on water infrastructure, hence the significance of this bill.

It is important that the funds are managed through the respective SRF programs to allow for a more local, needs-based approach rather than top-down directives. The downside is that some state programs are more proactive and better managed than others (e.g., Ohio). For this reason, Bluefield has encouraged vendors and solutions providers to take matters into their own hands and support smaller, resource constrained entities with SRF guidance as part of the sales process.

While many of the water-related allocations align with Bluefield’s August 2021 analysis of the Infrastructure Investment and Jobs Act (IIJA), additional changes have been made to facilitate management:

- Spearheaded by established state SRF programs grants, principal forgiveness loans must represent between 10% and 30% of the state total allocations.

- In contrast to prior years, the states will not be required to match 20% funding requests to lower state financial barriers to awarding needed projects. Bluefield’s annual project-by-project analysis of SRF requests—there were 12,012 requests in 2021—points to state’s inability to match or fully leverage federal funds.

- Buy America requirements will expand in SRF and WIFIA to include “manufactured goods,” in addition to the existing iron and steel Buy America requirements.

- The minimum percentage of funds that must go to disadvantaged communities would increase from 6% to 12%.

Cybersecurity concerns are addressed. Outside of the direct purview of the water funding, another US$1.3 billion will be allocated to cybersecurity that is plaguing American cities through ransomware attacks, operating system hacks, and personal data thefts. Utility challenges are compounded by budget and workforce limitations that increase the sector’s vulnerability. Recent industry surveys suggest that less than a third of North American utilities have implemented cyber intrusion technology to date. These funds are a recognition of the challenges ahead.

The water sector is not immune to these threats, as demonstrated in Oldsmar, Florida. Small utilities like Oldsmar often have fewer security safeguards and less in-house technical expertise to protect against increasingly sophisticated cyberattacks. The U.S. Department of Homeland Security will weigh allocations based on total population and rural population figures, with 25% of the obligated funds reserved for rural areas.

As Congress has seemingly crawled to the passage of this momentous bill, executives across the water sector have expressed some frustration that US$55 billion is not enough to take on the myriad of challenges. We at Bluefield take a more optimistic and expansive view, the passage of this legislation is a victory for the water sector in that it takes on lingering problems and, in some instances, looks to the future. No, it is not enough to close the investment gap, however, fortunately, it does establish accelerated deadlines to more quickly support new programs and agencies seeking to roll out funding. Resiliency is not an end unto itself, this victory is only the first step of more to come.