Water is mostly recession-proof, with residential demand up +21% in some communities, water mains still leak (if not bursting) at average rates of +15% nationwide, and water quality concerns remain– all while global economic growth evaporates. Of all the challenges facing regulators, utilities, and customers, water quality is the elephant in the room.

I’ll start with a couple of questions:

- If I asked you to drink tap water contaminated with PFAS (also known as forever chemicals), which might cause long-term harm to your health, would you? Of course not!

- If I suggested quenching your thirst with a liter of bottled spring water purchased at the grocery store for US$1.49 (don’t worry, I’ll pay for it), would you do so? Almost certainly.

Unfortunately for you, your family, and, quite honestly everyone else, both water sources might be contaminated. But not to worry, treatment technology is not the primary barrier to addressing the mounting stakeholder concerns over health risks associated with per- and polyfluoroalkyl substances (PFAS). In fact, technology solutions (e.g., GAC, RO, AER) are readily available from companies like Calgon Carbon, Evoqua, and Purolite, among others.

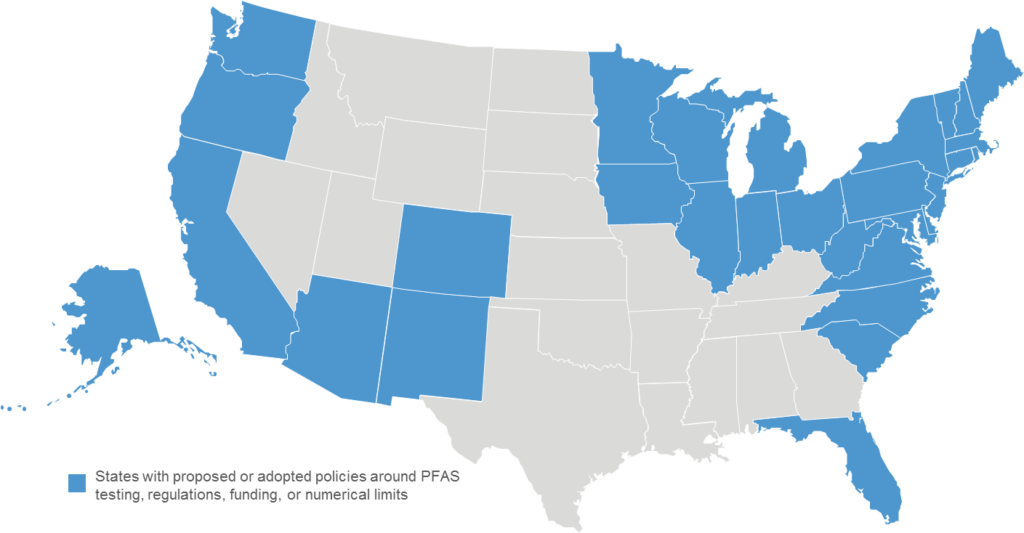

Any significant moves by utilities—and bottled water companies—to address these chemicals in water supplies hinge on federal and state regulators. Currently, there is no enforceable federal limit on PFAS in drinking water, although 29 U.S. states have implemented a mix of policy directives, including testing requirements, prohibitions on product applications (e.g., food packaging), and the elimination of select firefighting foam constituents. There are states at the leading edge of the market worth watching, as they are influencing policy discussions and ultimately the market opportunity.

In evaluating the market state-by-state at this early stage, Bluefield has forecasted US$12 billion of expenditures needed over the next decade to remediate impacted municipal drinking water supplies. When accounting for more widespread policy adoption and stronger federal guidance, our forecast model demonstrates an escalation in capital and operating expenditures based on more local and regional characteristics.

PFAS Drinking Water Policy Landscape Overview

Source: Bluefield Research

To date, 1,400 industrial and commercial sites have been identified in 49 states with varying amounts of PFAS contamination. The sites include military facilities, industrial sites, airports, and drinking water facilities. Among these, 223 community water systems that serve populations of +3,000 people in 12 states have tested positive for contamination. As more sites and systems are identified, growing concerns about financial accountability will increase as well.

Water utilities have already begun to challenge federal policymakers through a mix of lobbying efforts and lawsuits. Utilities, which were financially strapped six months ago, let alone today, are concerned about being stuck with the bill if these ‘forever chemicals” are declared hazardous under the federal Superfund law. Understandably, water utilities are not the ones that created the chemicals or profited from them. They just don’t want to be left cleaning up someone else’s mess without remuneration.

Admittedly, it is disheartening to learn recently of more than 700 state and municipal budget cuts, including a New Jersey roll-back of US$80 million in lead service line funding because of pandemic-related economic fallout. With 46 states commencing their fiscal calendars next week, the financial pain is about to become even more apparent. These are unfortunately the times we live in.

As the market for PFAS remediation evolves, Bluefield is supporting clients by tracking the regulatory shifts, legal implications, and factors shaping the outlook going forward.

The starting point is just a click away, FOCUS REPORT: PFAS, The Next Challenge for Water Utilities: Emerging Regulations, Technologies, and Forecasts, 2020-2030.

The starting point is just a click away, FOCUS REPORT: PFAS, The Next Challenge for Water Utilities: Emerging Regulations, Technologies, and Forecasts, 2020-2030.

Report Features:

- Database with 200+ impacted water systems by size and location

- State and federal policy dashboard

- Analysis of the competitive landscape including drinking treatment technology providers and biosolids service providers

- Economic analysis of biosolid management options and potential for market disruption due to PFAS

- 2020-2030 forecast of CAPEX and OPEX for drinking water PFAS remediation

>See the TOC, download sample pages from this report

To learn more about Bluefield’s ongoing analysis of municipal and industrial sectors, the impacts of recession and COVID-19 on water & wastewater markets, and the competitive landscape, visit: www.bluefieldresearch.com.