Barcelona, 7 August 2023: Another acute summer drought in southern Europe—combined with the first-ever EU regulation for wastewater reuse and an influx of resilience and recovery funds (RRF) for new projects—is driving investment in municipal wastewater reuse across Europe, according to a new report from Bluefield Research.

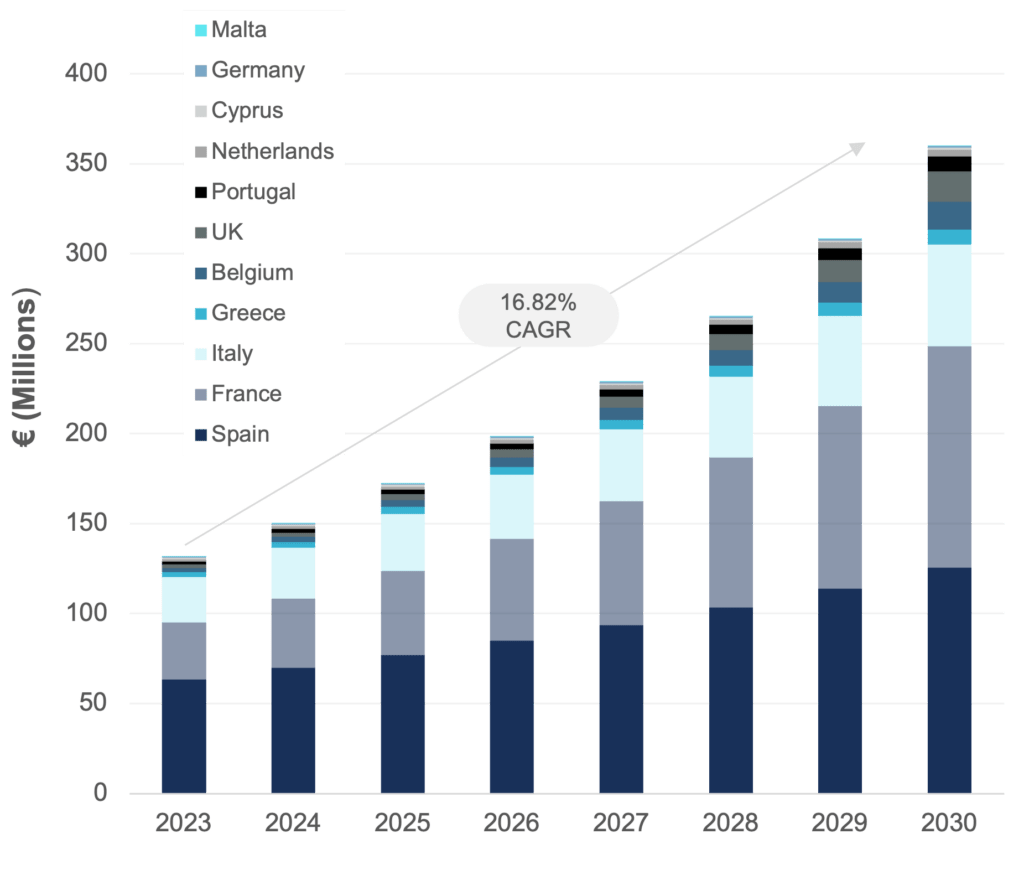

“Traditionally, the European market has been dominated by Spain’s reuse of treated municipal wastewater for its agricultural sector, but the market is changing and reuse is now expanding in 10 other European countries,” says Zineb Moumen, analyst at Bluefield Research. Municipal reuse spending in Europe is expected to grow from €140 million (US$154 million) in 2023 to approximately €360 million (US$396 million) in 2030 at a CAGR of 16% per year, according to Bluefield’s report, Europe Municipal Wastewater Reuse: Market Trends and Forecasts, 2023–2030.

“Multiple resource, policy, and economic factors are aligning to turbocharge Europe’s municipal reuse market,” says Moumen. “Combating drought with reuse is routine in southern Europe; what is unique now is that reuse is emerging as a viable supply option as far north as the U.K., and for industrial and environmental applications.”

The policy environment has grown especially favorable for reuse with the region’s focus on sustainable water management solutions, environmental goals, and the EU’s push for a circular economy. Both at the regional and national levels, governments set out national strategies for wastewater reuse, including ambitious targets for Portugal (30% of total municipal wastewater volumes reused by 2030) and France (10% by 2030). In addition, on 26 June 2023, the European Union (EU) passed its first EU-wide reuse legislation to harmonize wastewater reuse practices.

Highlighting the improved investment environment, Moumen stated, “The EU is implementing a public-private partnership funding mechanism that is vital to secure reuse project financing.” This will result in a substantial jump in spending for filtration and disinfection technology as well as accompanying pipe and storage tank infrastructure.

In southern Europe, where water stress is more pronounced, the reuse market has witnessed the greatest development. Mediterranean countries lead the adoption of schemes that tap into treated municipal wastewater resources, and they provide key benchmarks to facilitate ramp-up in less mature markets, according to Bluefield’s analysis.

Spain leads Europe with the largest reuse schemes, due to its perpetual water stress issues and its massive agricultural demand for water. The parched Spanish region of Murcia, representing 41% of the country’s agricultural exports, has achieved a remarkable 98% recycling rate of its treated municipal wastewater. Beyond this anchor market, other countries (e.g., France and Belgium) demonstrate strong potential and are pursuing reuse targets with supporting policy frameworks to advance their reuse initiatives.

Exhibit: CAPEX Outlook by EU Selected Countries, 2023–2030

Source: Bluefield Research

Agriculture represents 55% of reclaimed water volumes in Europe. However, the increasing focus on sustainability is prompting municipalities to pursue more urban-related reuse projects such as irrigation of public parks and recreational areas such as stadiums and golf courses, in addition to street cleaning with reused wastewater.

“Policymakers, farmers, industrial water users, and even citizens increasingly view treated municipal wastewater as a precious resource not to be squandered—especially during a drought,” noted Moumen. “Reuse is no longer an extreme measure for crisis response but rather a go-to option to support sustainable water strategies. This is already the case in southern Europe, and our research shows that reuse investment will accelerate throughout Europe in the next five to seven years.”