To put things in perspective, U.S. and Canada industrial sector withdrawals have declined 30% over the last three decades to 152 billion gallons per day (the daily equivalent of 760 billion bottles of your favorite bottled water). This trend, which is expected to continue, has been sparked by water-related technology improvements at facilities, company strategies to mitigate water supply risks, and outside pressure to better manage wastewater effluent through regulations and rising discharge costs.

It is difficult to argue that better water management doesn’t impact a company’s bottom line and positively reflect on a company’s environmental awareness and brand. At the same time, environmental conditions (e.g. drought) and policymakers are poised to play a more persuasive role. Look no further than water use reductions in an often parched California to wastewater discharge reductions into the fragile Chesapeake watershed. The water landscape is changing on many fronts, and companies are increasingly encouraged to take matters into their own hands.

This is a good thing, right? Well… yes and no.

The upside, 23% of industrial water management spend is allocated to reuse and expected to grow for the aforementioned reasons. Not to be overlooked, however, is a financial death spiral facing ill-equipped municipalities that is partly being shaped by these independent, industrial water management decisions.

In the U.S., approximately 20% of industrial facilities are monitored through National Pollutant Discharge Elimination System (NPDES)– a permit program to address water pollution by regulating point sources that discharge pollutants to waters of the United States. The remaining 80% discharge into 15,000 municipal utility network and distribution systems that are exposed to revenue risk and infrastructure degradation. Bluefield’s team of water experts has identified some perspectives:

- Utilities are volume-based businesses, incentivized to supply and treat higher flows. For every industrial system that moves to onsite reuse, let alone inherent water usage improvements via technology & equipment upgrades, unprepared utilities will be increasingly exposed to revenue losses. Scaling corporate interest in the deployment of decentralized water treatment & reuse systems and enabling business models will further accelerate this trend.

- Water infrastructure is designed for growth, not reductions. There are approximately three million miles of water, wastewater, and stormwater pipes in the U.S., according to Bluefield’s recent analysis of the municipal pipe networks. Declines in water demand are already forcing costly resizing of water pipes to maintain water quality standards. Further, a change in the makeup of wastewater effluent because of higher constituent concentrations are changing treatment methods but can also hasten corrosion of existing infrastructure.

- Industry is getting smarter and so will its water management. Industrial Internet of Things (IIoT) platform deployments in the global water industry remain scarce to date, but recent investments, acquisitions, and partnerships by GE, Schneider Electric, Rockwell, Siemens, and ABB indicate their strategic priorities are changing. The carryover will ultimately be more advanced digital solutions– directly and indirectly– impacting water management.While these longer-term challenges loom large, they represent opportunities for municipalities and industries to leverage this change. Data centers and energy companies are already off-taking reclaimed wastewater for cooling, and cities like San Francisco are partnering with property owners to promote onsite reuse. The key to tackling this challenge is to look beyond conventional wisdom and leverage the wealth of technology, solutions and and insights available.

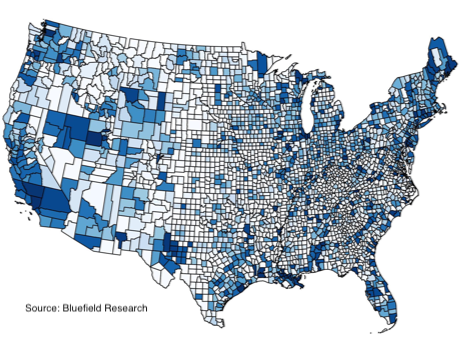

Bluefield’s analysis of more than 311,000 facilities across 3,000 U.S. counties and 10 Canadian provinces highlight the extreme geographic and water management variations of industrial facilities– oil & gas, chemicals, power, food & beverage, and light & heavy manufacturing. Whether you are industry company looking for opportunity in water or a municipal utility facing this new market landscape, Bluefield guides water market strategies.

Learn more about how Bluefield is helping companies make more informed decisions with data-backed intelligence.