The 2.3 million miles of drinking water pipe and 1.8 million miles of wastewater pipe installed across the U.S. vary significantly in age and material type. With current annual water & wastewater pipe replacement rates averaging less than 1.0%, utilities are increasingly turning to alternative methods and technologies to maximize the useful life of their buried assets.

As demand for trenchless solutions continues to scale, a growing roster of firms are carving out competitive positions in the market, including vertically integrated trenchless pure-plays, diversified chemical companies, specialty service providers, and private equity (PE) investors. These players face a dynamic market landscape, shaped by labor and supply chain shortages, record inflationary pressures, and an influx of federal and state infrastructure funding, such as the Infrastructure Investment and Jobs Act (IIJA).

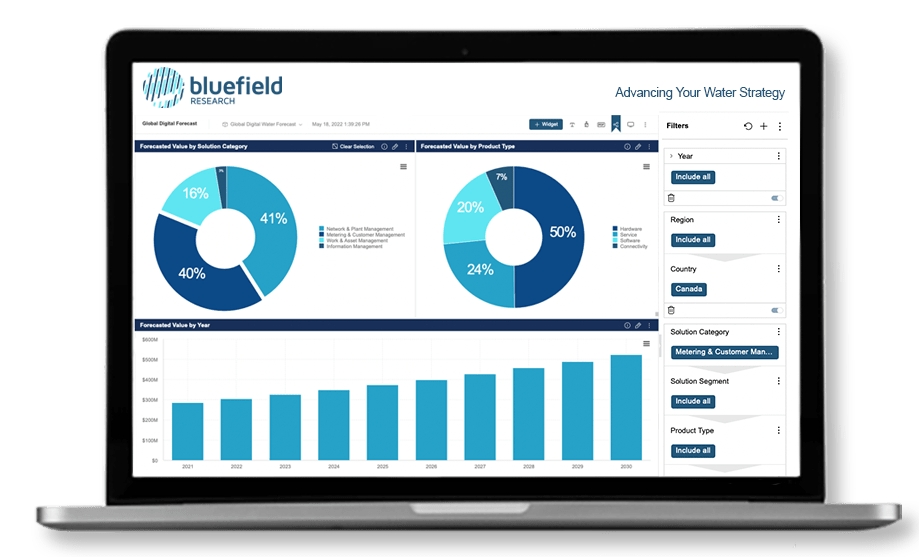

In this report, Bluefield’s team of water experts revisits the U.S. trenchless market, evaluating the impact of current supply and demand dynamics on the trenchless market outlook and competitive landscape from 2022 to 2030.

Report + Data Option:

Data is a key component to this analysis. Our team has compiled relevant data dashboards available as an add on purchase option. Select the “Report + Data” option in the drop down menu under Report Price.

Municipal Water Data Navigator seat holders can

Municipal Water Data Navigator seat holders can

access related dashboards now

Report Table of Contents

Section 1: Trenchless Market Landscape

- Forecast Methodology

- Aging Pipe Networks Drive Infrastructure Investment

- Material Shifts in Collection & Distribution Highlight Evolving Needs

- Trenchless Technologies Compete with Traditional Methods

- Trenchless Methods Gain Traction for New Installation & Rehabilitation

- Key Factors Influence Trenchless Technology Deployment

- Housing Starts Indicate Regional Demands

- Urbanization Rates Shape Addressable Market

Section 2: Key Market Drivers & Trends

- Market Shifts Shape Infrastructure Deployment

- IIJA Provides Critical Funding for Infrastructure Investment

- Supply Disruptions Result in High Material Costs

- Labor Supply Restricts Market

- Trenchless Project Costs Vary by Pipe Size, Application

Section 3: Trenchless Market Outlook, 2022–2030

- Trenchless Technology Spend Overview, 2022–2030

- Trenchless Share of Network Municipal Market

- Trenchless Spend by Segment, 2022–2030

- Trenchless Spend by New and Rehab, 2022–2030

- Trenchless Forecast by State, 2022–2030

- Trenchless Spend by Technology, 2022–2030

- CIPP Resins Play Important Role in Trenchless Market

- Trenchless Spend by Diameter, 2022–2030

- Adjacent Trenchless Technology Markets

Section 4: Competitive Landscape

- Competitive Trends Summary

- Trenchless Technology Value Chain (select companies)

- Trenchless Technology Company Type

- Trenchless Construction and Rehab M&A, 2021–2022