Boston, Massachusetts—The COVID-19 pandemic and associated economic fallout pose considerable threats to water & wastewater service providers and their stakeholders. Public utilities are now being forced to confront the cumulative impacts of revenue declines, shifting customer demand, and remote asset and workforce management. Recent analysis by Bluefield Research not only underscores the financial implications for utility capital (CAPEX) and operating (OPEX) expenditures but also highlights the pandemic’s role as a catalyst to realizing needed step-changes in municipal infrastructure investment and utility operations going forward.

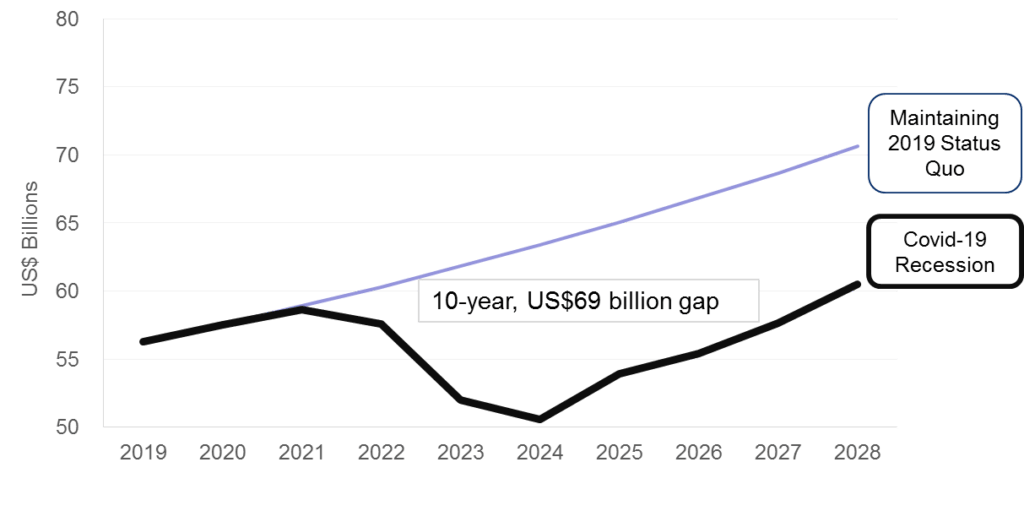

Historically, recessionary impacts on utility infrastructure spend have a lag of 18-to-24 months. In the absence of a meaningful stimulus package, annual CAPEX for new water & wastewater infrastructure and asset rehabilitation is forecasted to decline by as much as 21% in 2024, alone, and US$69 billion through 2029. This steep decline in CAPEX represents a major setback from the gains made during the decade-long economic expansion that only in 2018 brought the water sector back to pre-Great Recession levels.

In contrast, OPEX for ongoing operations & maintenance of existing systems will prove to be more resilient by growing at approximately 2% over the next decade, as utilities are forced to continue upkeep of existing aging assets.

“We can infer from the last four recessions that the financial impacts will stretch into the latter part of this decade, and the lion’s share of cuts will occur over the next three to four years”, says Reese Tisdale, President of Bluefield Research. “Even beyond this pandemic, a strategic infrastructure investment rethink has been needed, so this gives the industry an enormous opportunity to collectively make operational improvements and critical strides in investment priorities.”

Municipal Water & Wastewater CAPEX Forecast, COVID-19 Scenario

According to Bluefield, four key areas in municipal water are poised for change extending far beyond the current pandemic: remote management, affordability measures, utility customer communications, and dedicated resiliency planning are expected to accelerate.

• The shelter-in-place orders highlighted utilities’ lack of preparedness to manage a remote workforce and monitor and operate assets from a distance. Utilities managers have abruptly come face-to-face with the need to invest in these systems going forward to be truly resilient in the face of unpredictable disaster situations.

• Addressing customer affordability for water & wastewater services, a number of states and utilities have implemented shut-off moratoriums to protect end users. Utilities will have to take measures to equitably recover operating expenses in the near-term as businesses disappear and unemployment soars. The longer-term implications could be manifested in more progressive billing strategies.

• Public skepticism about the safety and availability of tap water, and unawareness of the impact of disposable wipes on wastewater collection systems, is forcing utilities to increase stakeholder education and engagement.

• Operational improvements toward greater resiliency are now imperative and must be accelerated with more robust planning processes that include digital transformation and workforce management.

Still unknown is the potential for a federal stimulus package, which will be critical to the reversing sector’s forecasted trajectory. In 2009, the American Recovery and Reinvestment Act allocated US$13.5 billion in federal funds to water & wastewater infrastructure for “shovel-ready” projects. This recession is proving to be more complex in that governments and utilities face massive revenues shortfalls and rising costs that will influence service provider’s decisions going forward.

“It is still too early to evaluate the fallout, but it is clear that Washington will need to step in to support faltering state and local authorities”, says Tisdale. “Of all the things that should be invested in, water is one that comes to mind because of the benefits lasting decades, including employment opportunities.”

###

Visit www.bfresearch.com for more information on Bluefield’s coverage of COVID-19 and its impact on water markets.