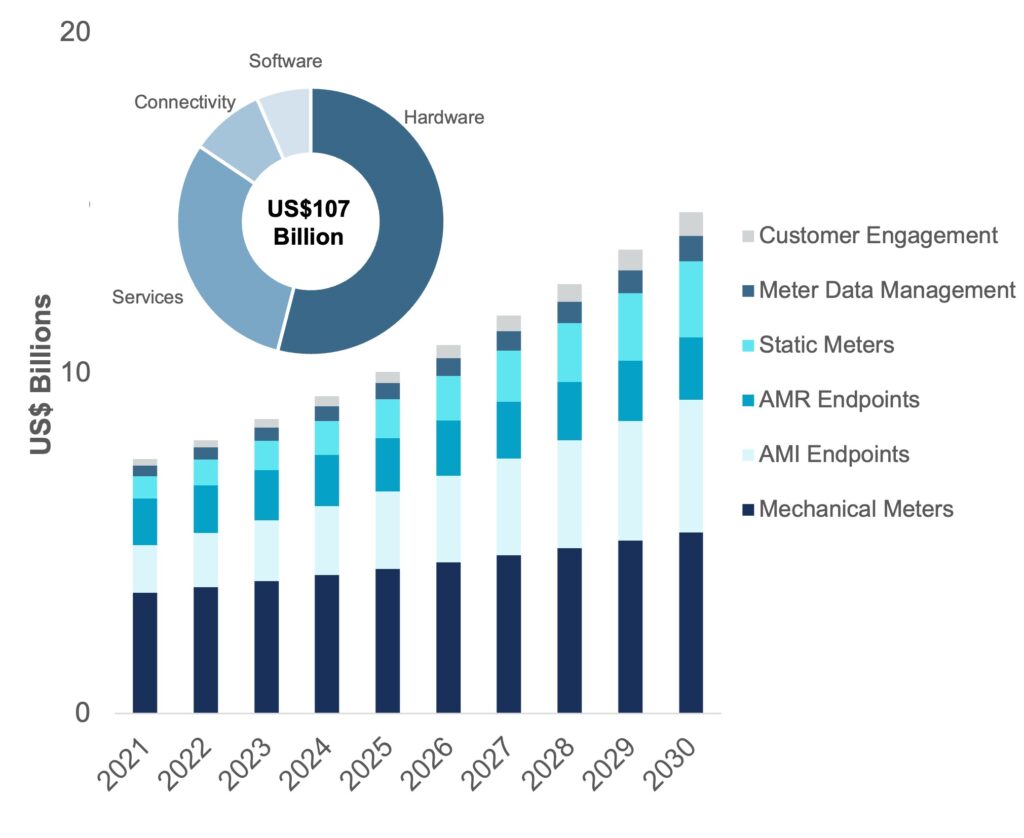

Boston, Massachusetts, 29 March 2023: The centuries-old global water metering market is at an inflection point, with new technologies and business models altering the competitive landscape and improving utilities’ access to data around consumers’ water usage. Bluefield projects that water meter technology and services spend globally will scale at a 7.9% CAGR from US$8.7 billion in 2023 to US$14.7 billion in 2030, for a total of US$107 billion by the end of this decade, according to a new report from Bluefield Research, The Global Water Metering Landscape: Technology Shifts, Competitive Landscape, and Market Outlook.

“We are seeing one of the most traditional segments of the water industry—water meters—undergoing unprecedented technological change and market disruption,” according to Eric Bindler, Senior Research Director for Bluefield Research. Long considered the “cash registers” of the water industry for their role in billing consumers for their water usage, cutting-edge metering systems combine new measurement and communications technologies with advanced analytics software to provide utility operators with crucial data and insights into a range of issues. “Real-time metering data is invaluable in helping water utilities around the world better address leakage and water scarcity, meet conservation and sustainability targets, monitor the condition and performance of aging water infrastructure, and proactively manage customer relationships,” says Bindler.

Breaking Down the Opportunity: Metering Technology and Services Outlook

Metering is the largest segment of the digital water market, representing over one third of projected global digital water spend over the next decade, according to Bluefield forecasts. An estimated 1.5 billion units—water meters and smart metering endpoints—will be sold globally this decade, with sales expected to reach all-time highs as meter manufacturers recover from post-pandemic supply chain disruptions and component shortages. “While the opportunity is global, there is a wide regional variation in utility technology preferences and adoption rates,” says Bindler.

Unlike other areas of digital water, U.S. utilities lead their more digitally mature European and Australian peers on smart metering adoption, with roughly 25% of U.S. metered connections currently equipped with fully remote-read capabilities. Meanwhile, emerging markets like China and India are at earlier stages of meter deployment, with sizeable opportunities for low-cost manual-read meters to be implemented alongside urban water infrastructure buildout. In Asia and Latin America, as much as 60% of water utility customers don’t have water meters—let alone smart meters—creating significant scope for investment and growth.

Exhibit: Global Water Metering Forecast by Segment & Product Type 2021–2030

Source: Bluefield Research

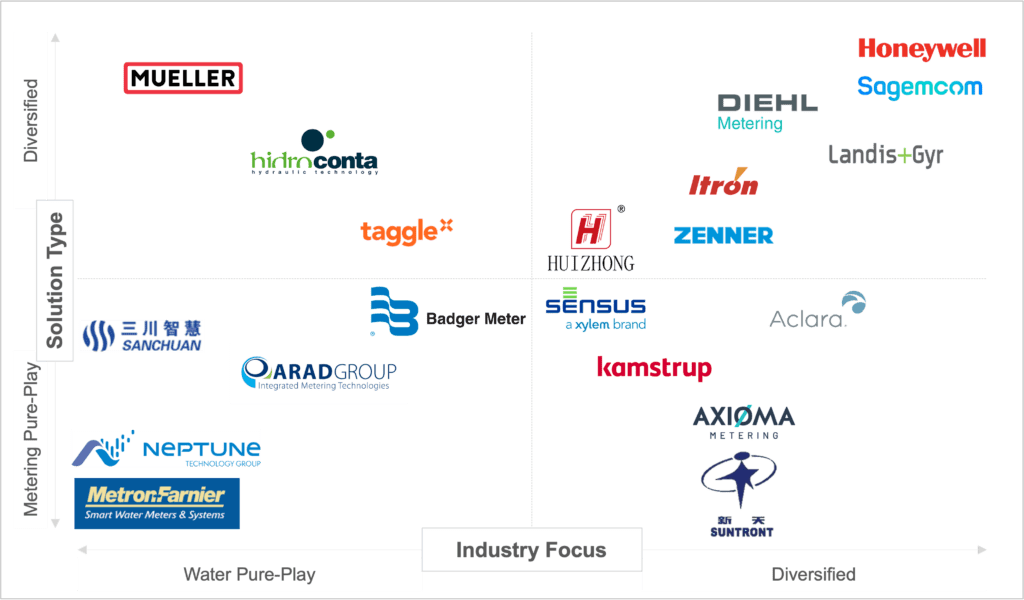

Diverse Roster of Firms Vie for Global Water Metering Market Dominance

Market and technology shifts are also shaking up the competitive landscape in the water metering segment, opening the door to a host of new competitors to traditional meter manufacturers. While several established U.S.-based providers (i.e., Sensus, Neptune Technology Group, and Itron) enjoy double-digit market share at a global level, new players from Europe (e.g., Kamstrup and Axioma Metering) and China (e.g., Sanchuan Wisdom, Suntront Technology) are making inroads in key regional markets. Meanwhile, leading players are increasingly seeking to tap into digital water market growth opportunities beyond the metering space. “Companies like Badger Meter and Mueller Water Products have expanded not just by buying other metering companies, but also by acquiring remote monitoring and IoT startups to diversify their portfolios of hardware, software, and data analytics offerings,” says Bindler.

Exhibit: Select Metering Firms by Solution Type & Industry Focus

Source: Bluefield Research

Beyond meter manufacturers, utility demand for innovative, digital water metering solutions also supports a growing ecosystem of metering software, communications, and service providers, attracting a wide array of new firms from other industries. “Water metering companies are beginning to face competition from electric and gas metering companies, telecom providers, professional service and consulting firms, and even big tech players. We expect the metering competitive landscape to change significantly in the coming years as more companies—many new to water—look to leverage this growing market opportunity,” says Bindler.