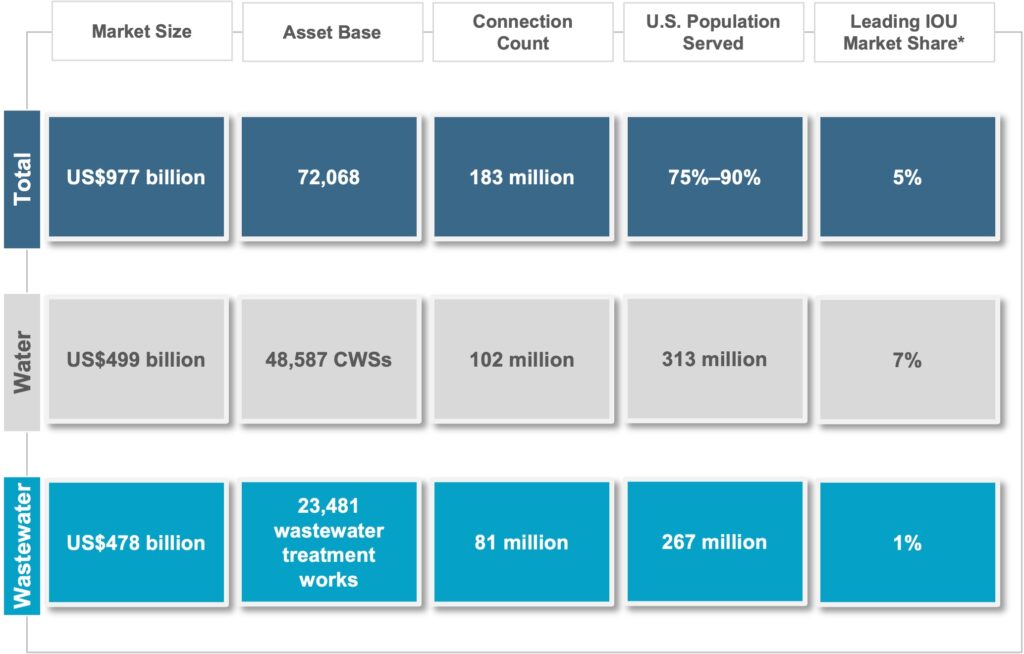

30 June 2023, Boston, Massachusetts: Amid growing calls for utility consolidation of a highly fragmented U.S. water sector, the total addressable market opportunity for utility ownership of the country’s 183 million customer connections has reached US$977 billion, according to a new report from Bluefield Research, Total Addressable Market for Water & Wastewater Utilities: U.S. Benchmarks for Owner Market Share and Consolidation Opportunities.

The municipal water landscape is made up of approximately 48,000 community water systems and 23,000 wastewater treatment facilities serving roughly 80% percent of the U.S. population. The owners of these systems vary widely from municipalities to tribes, utility districts, homeowners’ associations, and investor-owned utilities (IOUs).

“One trend we are seeing in the U.S. municipal water space is a gradual move toward consolidation. Utilities are leveraging a range of strategies to bring splintered utility assets to a more manageable scale—financially, operationally, and technically. This includes annexation (moving the utility into city limits), regionalization, and privatization,” according to Isabel Kezman, senior analyst for Bluefield Research.

“The U.S. municipal water sector is highly fragmented, meaning we must consider a number of factors when establishing the total addressable market for utility consolidation. We have analyzed over 1,200 public and private utility mergers and acquisitions approved by state commissions over the last eight years—collecting key metrics such as acquisition size, buyer and seller ownership type, legal frameworks facilitating deals, and the price paid by buyers per customer connection acquired (cost per connection). These are all inputs that helped us quantify the overall market opportunity for utility ownership,” says Kezman.

Exhibit: Total Addressable Market Overview

Source: Bluefield Research

Historically, these very small and small systems have been the main targets of consolidation, representing 68% of the 964 utility acquisitions by private buyers in Bluefield’s data since 2015. “We expect this trend to continue in light of mounting regulatory pressures (e.g., PFAS) and aging infrastructure,” adds Kezman.

One group of buyers that is especially acquisitive is the investor-owned utilities (IOUs), or privately held and publicly traded companies that provide water and wastewater services in the same way as a municipality. Bluefield tracks the market activity of nearly 30 of the country’s largest and/or most competitive IOUs. As part of the Total Addressable Market exercise, Bluefield identified that these top IOUs own an estimated 5% of the 183 million customers that make up the U.S. municipal landscape.

New Jersey-based American Water, the largest IOU, has approximately 40% market share within its leading IOU peer group based on its total customer connections served, according to Bluefield’s analysis. “However, the competitive landscape is changing among established (IOUs) like SouthWest Water Company, Veolia, and California Water Services Group, and new market entrants, such as Central States Water Resources. These investor-owned utilities are looking not just at water assets, but also at wastewater assets as an opportunity for growth and consolidation,” says Kezman. On average, there are 148 utility acquisition deals per year, according to Bluefield’s M&A data. Private buyers (i.e., IOUs) represent the majority of this activity.

“Consolidation is just one path (or solution) to address the countless challenges facing the U.S. municipal water and wastewater sector,” says Kezman. Other alternatives include third-party O&M services contracts, utility cooperatives, and public-private partnerships.