Boston, Massachusetts: The convergence of financial stress and aging pipe infrastructure for water & wastewater utilities presents a unique opportunity for trenchless technology solutions providers to expand their market positions. According to Bluefield Research, the forecasted 3.4% growth rate for trenchless technology deployments will outpace broader municipal water infrastructure investment in a post COVID-19, recessionary environment.

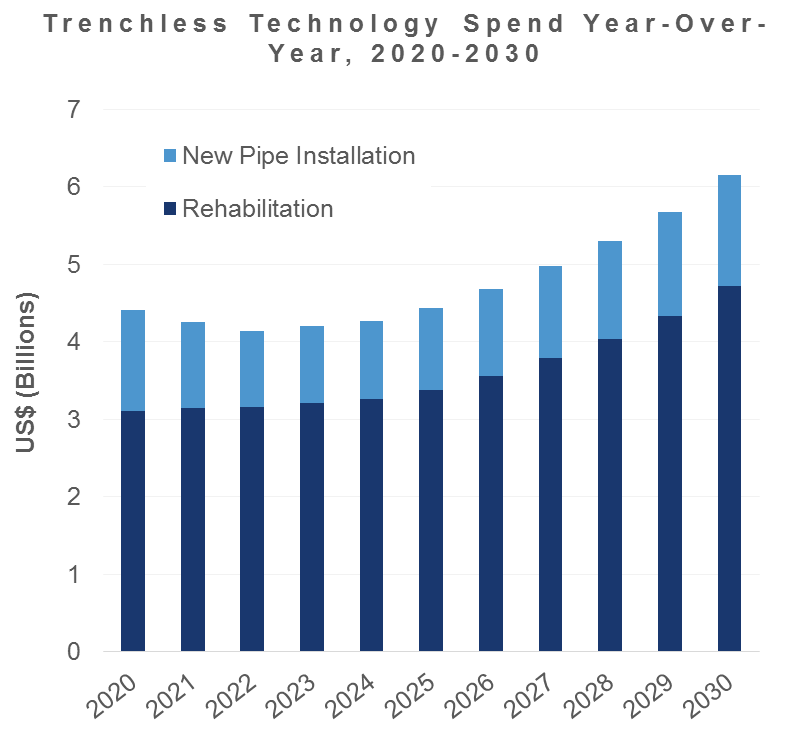

Bluefield’s new report, Trenchless Players Move to Redefine Pipe Market: Forecasts, Competitive Positioning, and Water Market Trends, 2020-2030, shows total spend across the range of trenchless technology options exceeding US$52.5 billion over the next decade. The lion’s share (76%) of this spend will focus on the rehabilitation of underground assets, while the remainder of spend will be for new construction.

“Due to its cost-effectiveness, reduced environmental impact, and quicker project timelines, trenchless offers a potential bright spot for growth in a municipal market that is bracing for looming financial impacts,” notes Bluefield Analyst Mariel Marchand. “Trenchless solutions have been promoted as a cheaper alternative to traditional technologies and could save as much as 30% on total project costs in urban areas.”

In contrast to more traditional, open-cut pipe rehabilitation techniques, which often require digging up the entire length of pipe, trenchless alternatives offer a less invasive way to rehabilitate existing pipes by lining or coating the inside of the pipe through smaller access points. As such, trenchless companies aim to minimize costly disruptions, such as traffic and business impacts, which can lead to faster speed of delivery and reduced labor needs.

At the forefront of forecasted market growth will be cured-in-place pipe (CIPP) technology that accounts for 36% of total spend, followed by horizontal directional drilling. The primary opportunity will be refurbishing the broader 1.8-million-mile wastewater pipe sector, although increasing focus on water pipe leakage is also driving innovation and longer-term opportunities.

The competitive landscape has begun to shift through M&A and new market entry. Over the last four years, Bluefield has identified 18 company acquisitions including deals by Toro, Granite Construction, and Vortex. Through these acquisitions, companies are positioning themselves to gain market share, while more established market leaders expand their product portfolios. Aegion’s Insituform business unit continues to be the proven market leader with its CIPP solutions.

“Trenchless technologies are not new, but the growing interest from private equity and strategic investors signals a more competitive landscape that bears watching,” says Marchand. “Given the economic downturn and resulting financial constraints on municipal stakeholders, a push to extend the life of assets with fewer capital costs will be an increasingly attractive option.”

About Bluefield Research

Bluefield Research provides data, analysis, and insights on global water markets. Executives rely on our water experts to validate their assumptions, address critical questions, and strengthen strategic planning processes. Bluefield works with key decision makers at municipal utilities, engineering, procurement and construction firms, technology and equipment suppliers, and investment firms.