Boston, Massachusetts— Digital water in the U.S. & Canada is forecasted to grow 6.5% annually, far outpacing the growth of the broader municipal water & wastewater sector over the next decade. During this same period, annual capital expenditures for digital water solutions will rise from US$5.4 billion in 2019 to US$10.8 billion in 2030, setting the stage for more advanced monitoring and management of critical infrastructure.

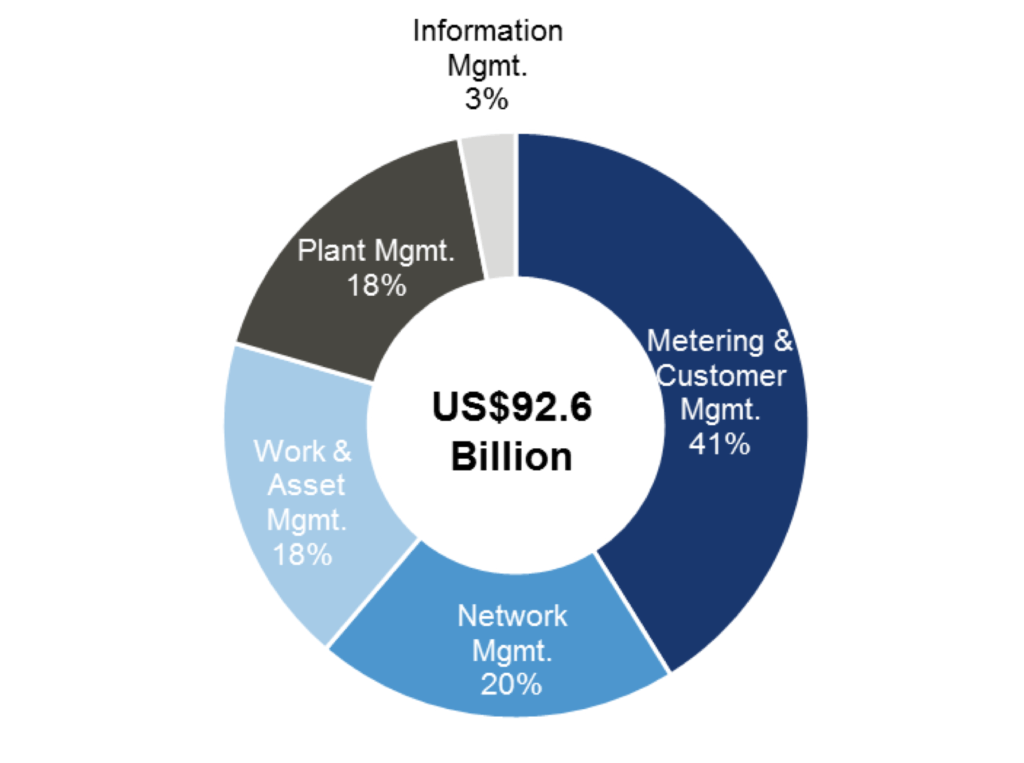

According to Bluefield Research’s new report, Water Industry 4.0: U.S. & Canada Digital Water Market Forecast, 2019-2030, utility spending on connected hardware, software solutions, and digitally enabled professional services will reach a combined US$92.6 billion over twelve years. This investment has been catalyzed by a wave of newly available technology solutions, increasing customer expectations, and utility leaders’ reliance on data to tackle mounting financial and environmental pressures.

“Digital water is becoming the most dynamic slice of municipal water. This is evidenced by growth rates exceeding the historical 2% for water,” says Eric Bindler, Research Director for Digital Water. “By leveraging smart technologies, shifts in communication platforms like 5G, automation, and predictive analytics, cities and utilities should be better prepared to address costly water and wastewater infrastructure issues.”

Exhibit: U.S. & Canada Digital Water Market Totals by Technology Category (2019-2030)

The complexity of digital water solutions and their applications are highlighted by Bluefield’s analysis of five key technology segments (see Exhibit) and their underlying 19 subsegments.

“Often representing utilities’ first foray into digital water, metering is the meat and potatoes of the digital water sector, accounting for 41% of projected investment.” says Mr. Bindler. “Meters sit at the interface between the utility network and the customers, providing utilities with critical data and insights on network infrastructure status and customer behavior.”

The fastest growing technology segment is Information Management; while still small in total market share at 3%, this segment is growing at a 15% clip. The accelerated growth is driven by the increasing flow of data from all utility departments (e.g. customer service, operations, finance) that needs to be collected, organized, and leveraged for analysis.

Larger utilities are also turning to artificial intelligence to address network and customer challenges including water loss, aging infrastructure, and unforeseen climate events. Bluefield’s forecast finds AI technologies represent significant market opportunity with $6.3 billion projected investment by 2030.

“Data continues to play an integral role in business strategies and the water industry is no exception. We expect that digital water adoption will become increasingly mainstream, as utilities of all sizes recognize the value of data for improving network performance, customer relationships, and infrastructure investment decisions,” says Mr. Bindler.

About Bluefield Research

Bluefield Research provides data, analysis, and insights on global water markets. Executives rely on our water experts to validate their assumptions, address critical questions, and strengthen strategic planning processes. Bluefield works with key decision makers at municipal utilities, engineering, procurement and construction firms, technology and equipment suppliers, and investment firms. Learn more at www.bluefieldresearch.com.