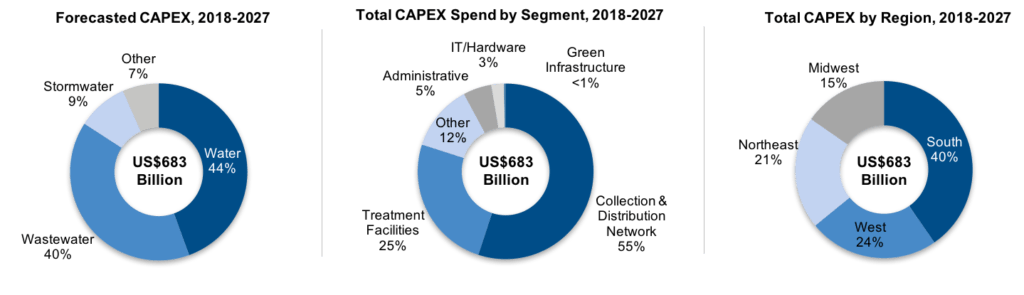

Boston, Massachusetts, 3 April 2018– Capital expenditures (CAPEX) for U.S. municipal water, wastewater, and stormwater infrastructure will exceed $683 billion over the next decade, according to new forecasts from Bluefield Research.

“The public’s growing concerns about U.S. water infrastructure are real and increasingly reflected in utility planning documents. Our analysis of utility capital improvement plans in 100 cities demonstrates the wide range of capital needs across the water industry, from manhole covers and fire hydrants to information technologies,” according to Erin Bonney Casey, Research Director for Bluefield Research.

Each system across the U.S. faces unique challenges. Per capita spend by utility for the ten-year forecast period ranges from a low of US$157 in Riverside County, California to a high of US$11,117 in Miami-Dade County. The average across the utilities analyzed is US$2,621. High per capita spend is often related to a specific driver, including environmental consent decrees to remediate stormwater overflows and acute water quality challenges in cities like Jackson, Mississippi or Pittsburgh, Pennsylvania.

Sizing the Market – Municipal Water and Wastewater Outlook

Source: Bluefield Research

Pipe investment dominates water infrastructure spend

With leakage a key issue plaguing the water industry, investment in pipes continues to dominate water infrastructure spend. Almost two trillion gallons of water per year are lost to leaks, about 15% of the total drinking water treated in the U.S.

The distribution and collection networks for water and wastewater– pipes, pumps, tanks, valves– dominate the forecast, surpassing $375 billion of the ten-year total. Pipes represent 75% of this spend, of which more than 60% is dedicated to rehabilitation of existing networks.

“The underground pipe networks for water, wastewater, and stormwater in the U.S. exceed 1.6 million miles, which is enough for almost three roundtrips to the moon. It is no wonder that this is where the dollars are going and will continue to go”, says Ms. Bonney Casey. “The longer-term challenge is keeping pace financially with network deterioration.”

New solutions emerge in a mature market sector

Bluefield has also identified new areas of growth for more advanced solutions to address chronic water infrastructure issues. CAPEX for information technology inspired segments like smart water will contribute more than US$16 billion. While metering hardware represents the lion’s share of this spend, utilities are now investing in “Big Data” solutions, as the water sector looks for more efficient ways to map, analyze, rehabilitate, and operate aging water and wastewater systems.

Utilities are also prioritizing resiliency with their capital allocations. In the wake of concerns about large storm events, increasing attention has been devoted to wastewater and stormwater impacts on the environment. This is driving an increase in combined CAPEX from US$31.8 billion in 2018 to US$35.3 billion in 2027, including funding for new approaches, such as green infrastructure.

“It is abundantly clear that water infrastructure needs are growing and utilities are investing accordingly,” says Ms. Bonney Casey. “Of the 52 utilities we analyzed in both our 2016 and 2018 forecasts, 32 show an increase in capital improvement planning budgets growth, with an average growth of 47 percent. What is most notable, though, is the areas in which utilities are now choosing to focus their dollars: whether it be resiliency, data and analytics, green infrastructure, stormwater overflows – the needs are many and they can vary by region, and utility.”

About our Forecasts:

These and other findings are found in Bluefield’s new report, U.S. Municipal Water Infrastructure: Utility Strategies & CAPEX Forecasts, 2018-2027, released in April 2018. These forecasts draw heavily from detailed, bottom-up analysis of capital improvement plans at utilities across in 100 U.S. cities in all 50 U.S. states.

About Bluefield Research:

Bluefield Research provides data, analysis and insights on global water markets. Executives rely on our water experts to validate their assumptions, address critical questions, and strengthen strategic planning processes. Bluefield works with key decision-makers at municipal utilities, engineering, procurement, & construction firms, technology and equipment suppliers, and investment firms.