Globally, the energy and transportation sectors are undergoing tectonic shifts, from scaling demand for intermittent renewable energy generation, to the emergence of electric vehicles. While the “greening” of these two critical infrastructure landscapes is not shocking, the underlying role of water in securing critical raw materials—lithium, nickel, cobalt, and copper—is news to many.

Key to both the energy and transportation industries is a reliance on lithium and copper, as well as other hard rock metals. Lithium and copper are crucial components in electronic vehicle batteries, electronic vehicle infrastructure, wind turbine motors, and photovoltaic solar energy storage systems. As renewable power generation is forecasted to account for almost 95% of the increase in global power capacity through 2026, and as electric vehicle production has doubled in a single year, reporting a 102% year-over-year increase in 2021, demand for these raw minerals is expected to dramatically rise.

Lithium mining, to use one example, is a water-intensive industry, requiring an estimated 500,000 gallons of water per one metric ton of lithium mined. While advanced water technology and solutions to address the sector’s water intensity are well demonstrated, changing political and regulatory winds in key markets like Chile are refocusing the spotlight on the mining sector’s immense water use.

With all the technology, innovation, and human capital being deployed to identify new sources of key raw materials to support the growing demand for lithium, nickel, cobalt, and copper, water’s role in the equation must be defined.

With all the technology, innovation, and human capital being deployed to identify new sources of key raw materials to support the growing demand for lithium, nickel, cobalt, and copper, water’s role in the equation must be defined:

Water demand to scale alongside increased exploration. Although the average water usage per metric ton of mineral mined varies significantly, the sheer increase in demand for copper, lithium, cobalt, and nickel will require water supply to scale as needed. To put this into perspective, copper production alone will need to increase by more than 1000% for electronic vehicle charging infrastructure by 2030 compared to 2020, and double to meet other growing renewable energy technology demands. Similarly, the projected increases in electronic vehicle production will send lithium’s status as a relatively small market commodity into seismic expansion.

The increase in demand has already been reflected in prices. In 2021, lithium rose 164%, while nickel, cobalt, and copper experienced more modest yet sizable double-digit increases—35%, 31%, and 33%, respectively.

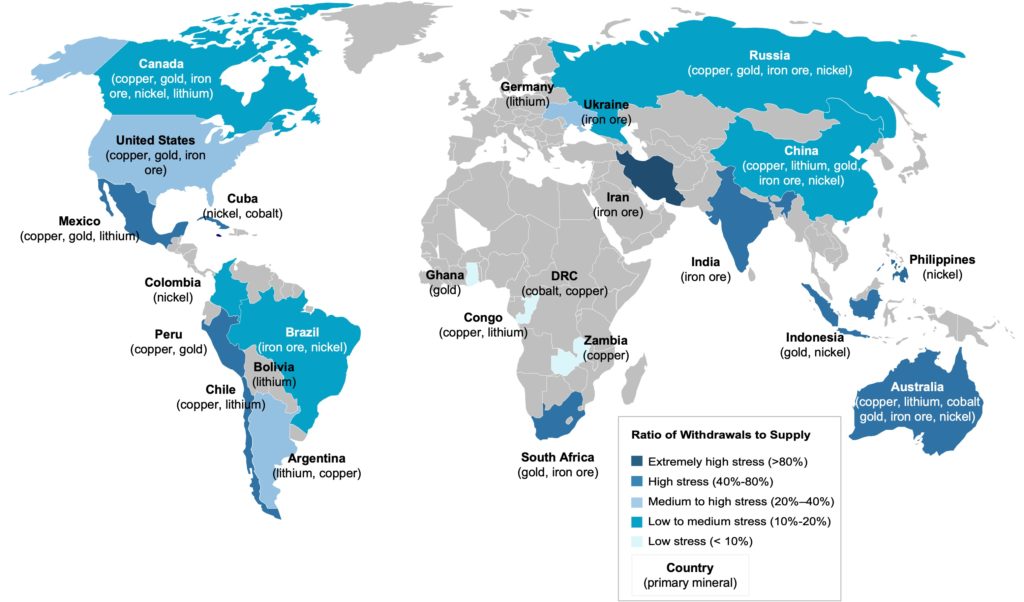

Water stressed regions, relying on mineral exploration, look to alternative supplies. It should be no surprise that mineral exploration is more often in remote regions of water stress, including Chile, Peru, Western Australia, Western North America, and Southern Africa. For this reason, alternative water supplies are projected to equal the use of freshwater in mining within a decade. In Chile alone, more than 15 new desalination plants or pipeline systems have been announced to supply treated water to mines by 2028.

Chile, the world’s leading producer of copper and second of lithium, is undergoing its 13th-year of drought, and the impacts are being demonstrated across the mining sector. In the first quarter of 2022, Anglo American’s Los Bronces mine and Antofagasta Minerals Los Pelambres’ mine reported production declines of 17% and 24%, respectively, with lack of water being cited as having played a key role. For this reason, the importance of Antofagasta’s desalination plant coming online later this year is worth noting. The company is targeting 90% of the mine’s water to be sourced from the ocean or recirculation by 2025.

Global Water Stress

Source: World Resources Institute, Bluefield Research

Water for mining, from supply to discharge, is drawing focus on environmental impacts. Foreseeing risks to water supplies for other industrial and domestic uses, key markets including Chile, South Africa, and Australia, are moving towards additional regulations on water supplies and wastewater discharges to minimize environmental impact. In regard to water supply, these water-stressed countries are looking to mitigate competition for water (i.e., domestic and industrial uses versus mining), creating opportunities for water technology vendors and alternative water suppliers. Regarding wastewater discharge, increased regulations of effluents (i.e., acid mine drainage) will create opportunities for wastewater management and reuse providers.

As we continue to see more Tesla’s on the roads, wind farms along highways, and solar panels on roofs, we must not forget about the raw materials themselves—as well as the water needed to procure them.