The water industry has come a long way, and yet we still have so far to go – nowhere is that more evident than in digital water. This message resonated with me at the 2019 Smart Water Networks Forum (SWAN) conference in Miami last month, where I was struck by two things: First, the ongoing innovations in technologies like artificial intelligence and the digital twin. Second, the realization that we are still working to solve age-old water industry challenges, like overcoming entrenched cultural resistance to innovation and change within the municipal water sector.

This was the first time that SWAN– an international digital water industry association comprised of utilities, vendors, and industry experts– held its annual gathering in the U.S., a positive indicator for the market in and of itself. The diverse companies attending reinforce the interest in, and the need to mitigate water infrastructure issues through, digital transformation. Even so, we all wonder– when will the US catch up with other leading markets like the U.K. and Australia? At Bluefield, we already track 300+ digital water vendors of varying shapes and sizes, most of which have set their sights on the massive need for capital and operating efficiency gains in the U.S. municipal market.

While the issues remain complex, I believe that the industry itself is getting smarter. Here are my takeaways from the SWAN 2019 conference:

- From Digital Twin to Artificial Intelligence, exciting new technologies will make water smarter. As Bluefield’s recent collaboration with Arcadis highlights, emerging technologies such as artificial intelligence and predictive analytics can empower utility leaders to address longstanding challenges, like affordability and resilience. There was no shortage of interest in these technologies at the conference, as our standing room-only intelligent water roundtable with Arcadis illustrated. Even so, the majority of the 70,000+ U.S. water & wastewater utilities are still in the early stages of their digital water journeys– establishing core collection and visualization platforms, like SCADAand GIS– and it may still be a number of years before the budding interest in more cutting-edge digital solutions is converted into tangible results at scale.

A cultural shift will be required to transition from siloed thinking toward a more integrated digital water approach. It will also require a greater tolerance for controlled experimentation– and even for failure– to prepare for challenges, not just today, but those well over the horizon.

- Investment in Smart Metering is driven by water scarcity, customer needs. Though smart meter vendors were not as prominent at this year’s SWAN conference as in past years, AMI and AMR deployments still account for the lion’s share of U.S. digital water project activity, as tracked through Bluefield’s project deployment database. This highlights the fact that water utilities’ journey towards greater digitalization is partly being driven by scarcity (e.g. California drought) and more focused needs for improved customer management. The challenge for smart meter vendors and other digital water solutions providers is to help utilities glean actionable insights into network performance and customer behavior from core metering data, and integrate this data into operating and planning systems and workflows.

- People aren’t the problem, they are the solution. In poll after poll, conference participants confirmed that the roadblock to smart water technology adoption tends to be people. Many utility leaders have not been convinced that their needs are (or will) be addressed by a bulging list of vendors. Representative questions raised include:

- Who (and what role) is the right person to address in a utility?

- What are tell-tale signs of a ‘progressive’ utility?

- How does one get past a siloed business case approach to recognizing more holistic value?

A cultural shift will be required at the leadership level to transition from traditional, siloed thinking toward a more integrated utility approach. It will also require a greater tolerance for controlled experimentation– and even for failure– to prepare for challenges, not just today, but those well over the horizon.

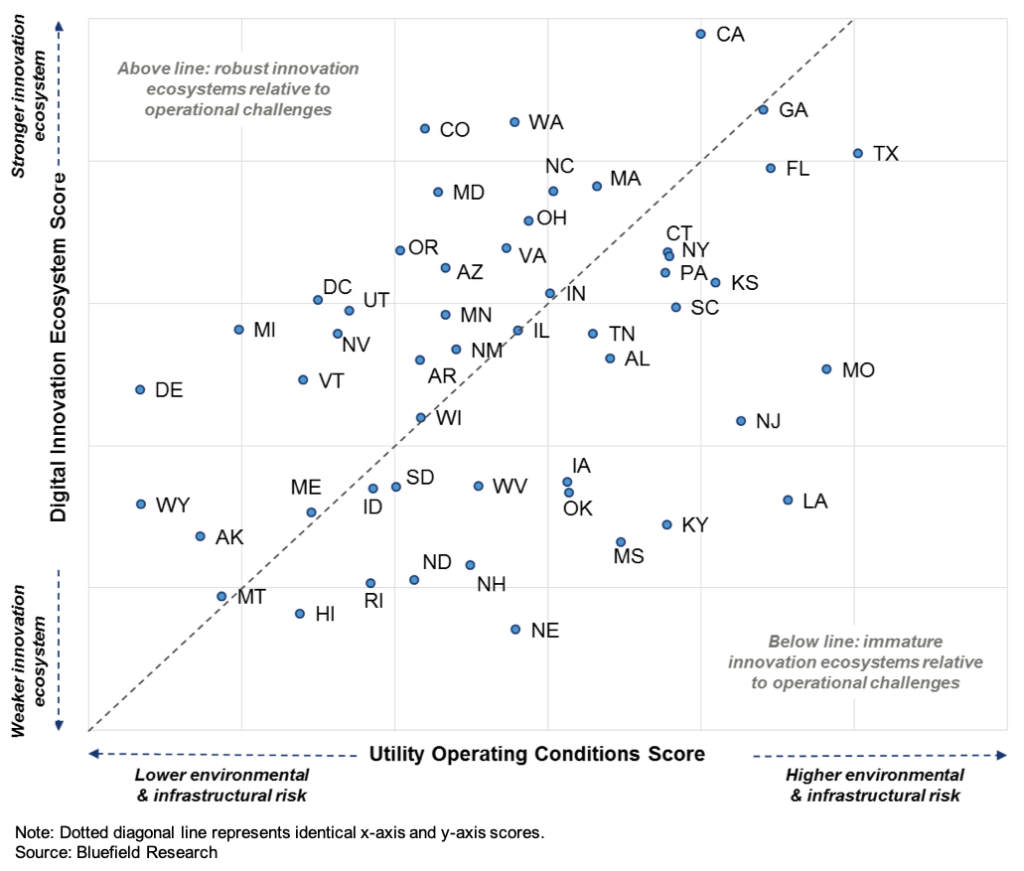

At Bluefield, we have begun to evaluate questions of utility culture and innovation on a state-by-state basis to guide vendors and utilities in their strategic thinking. I presented our findings, Water Innovation Ecosystems: Facilitating the Digital Water Journey, to a well-attended panel of conference participants, also available in a recent Analyst Perspective.

Exhibit: Bluefield Rankings of Digital Water Innovation Ecosystems by State

Source: Bluefield Research

- Everyone must show ROI, water utilities are no different. There are a host of innovative utilities, in states with favorable market environments, that are driving smart water markets forward. Impressive presentations from progressive utilities such as WSSC, DC Water, and Seattle Public Utilities, often considered the “smart water” poster children, demonstrate the value of advanced analytics to their systems and customers. Smart water vendors and their more forward-thinking utility clients largely agree on the value of digital technologies, but they often find it difficult to craft clear business cases with quantifiable returns on investment to more skeptical prospects.

These are big issues that the water industry is grappling with– some new, some old. At Bluefield, we provide our clients with an independent, holistic view of key issues, trends, challenges, and opportunities in water. With an independent perspective, and exclusive focus on water, we’re here to help usher the water industry into the future. Learn more at www.bluefieldresearch.com.