Currently, more than 700 water reuse projects in Europe are garnering significant attention in the wake of drought and extremely high temperatures that swept across the continent during the summer of 2022. As if the global supply chains don’t already have enough challenges, a host of water-related disruptions are altering river transport, power generation, and agriculture output shining a spotlight on water availability, usage, and efficiency measures. Hosepipe restrictions and fleeting conservation mandates only go so far in the heat of the moment.

As such, the EU’s “climate neutral by 2050” target underlies more deliberate efforts to implement circular approaches to managing water resources and the economy, for which municipal and industrial water reuse plays an important role. Not only does water reuse (or more crudely put, recycling municipal and industrial wastewater for other uses) make sense from a water supply standpoint, it also can play a role in limiting energy demand (i.e., reduce carbon emissions).

In evaluating recent trends in reuse in the EU, Bluefield’s team has been working with clients to unravel key regulatory drivers and project development opportunities. Some takeaways include:

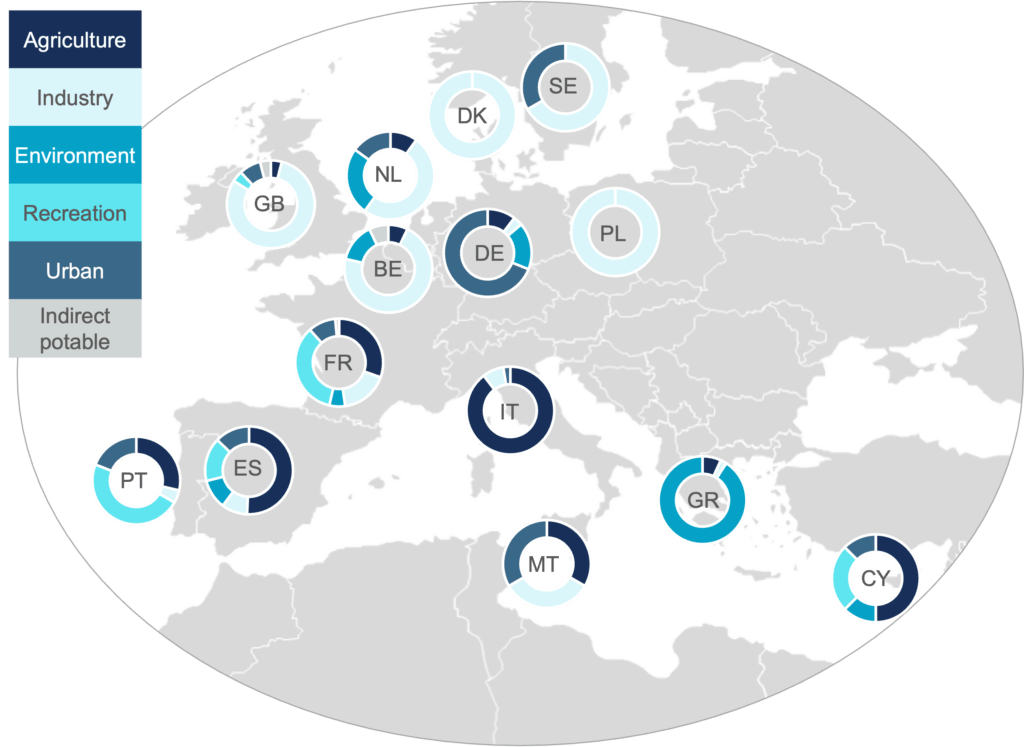

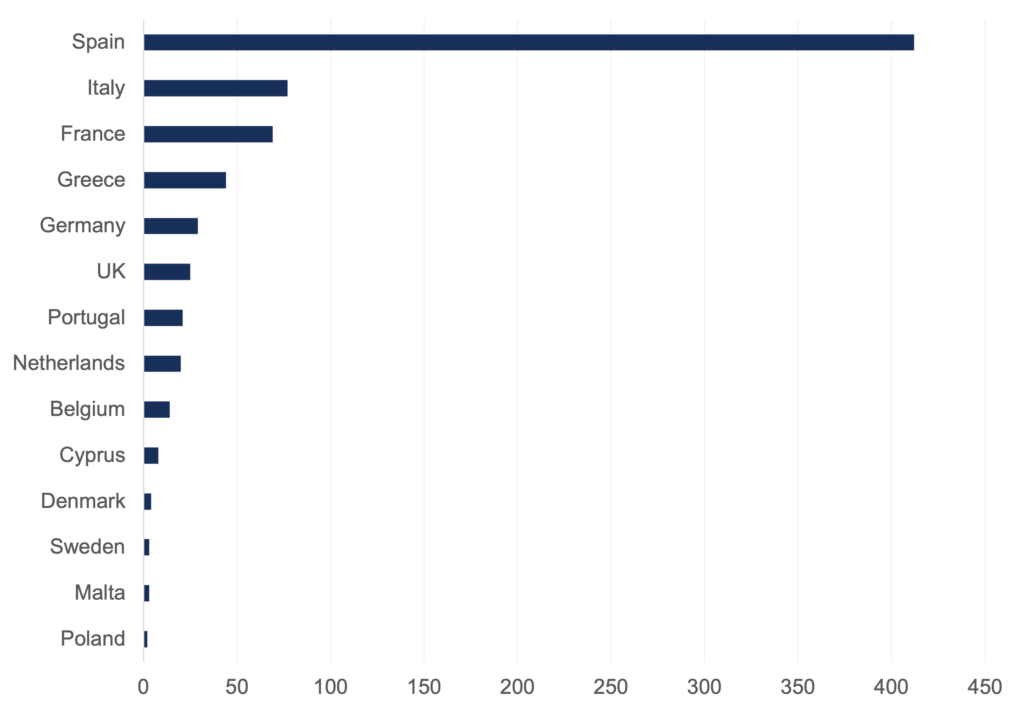

To date, reuse in Europe tilts toward irrigation. To curb water scarcity, over 60% of the overall reuse project activity in the EU targets irrigation, including crops and recreational areas (e.g., public gardens, parks, golf courses) as the offtakers. Without surprise, the EU countries most prone to water scarcity show the highest number of projects. Reuse activity in Spain and Italy (and to a lesser extent Portugal and France) point to agriculture as the key offtaker for recycled water.

Exhibit: Share of Reuse Projects in Europe, by Application

Source: Water Reuse Europe, Bluefield Research

Going forward, however, this trend could shift to include more industrial reuse applications for processing water supplies, facility and datacenter cooling. As existing project data demonstrates, the growth is likely to be seen in Northern Europe, where both light and heavy manufacturing plays a larger role in the local economies. Recently, TotalEnergies signed a contract with Antwerp’s water supplier Water-Link and partners Aquafin, Ekopak and PMV at the Port of Antwerp-Bruges in Flanders. By recycling wastewater from some 280,000 Antwerp residents, the French oil & gas multinational will save up to nine billion liters of drinking water each year. A €100 million investment towards a new treatment plant is expected to facilitate the activities.

Exhibit: Number of Reuse Projects by Country

Source: Water Reuse Europe, Bluefield Research

Policies evolving to address longer list of concerns, new pathogens and cost recovery. In recent months, the European Commission published guidelines to guide member states and stakeholders on the safe reuse of treated urban wastewater for agricultural irrigation. This regulation, which comes into effect in June 2023, sets minimum water quality, risk management, and monitoring requirements for water reuse.

Increasingly, new pathogens and threats to human health, such as PFAS, are finding their way into the water cycle and could disrupt traditional business models (i.e., biosolid spreading as fertilizer). As such, it is expected that France and Spain will need to make substantial investments to upgrade treatment trains to be in compliance. So far, the lack of a coherent framework, combined with a limited knowledge of reuse benefits—among industry stakeholders and the public—remain key inhibitors to a wider adoption. The technology has been proven out, as demonstrated from Singapore to Southern California, where direct and indirect potable reuse systems are operational.

Balancing the economics of reuse projects still a challenge. The economics of reuse schemes continue to present significant obstacles, particularly at the municipal level. Underlying these challenges is the EU Water Framework Directive, which demands utilities achieve full cost recovery for water services. This poses a challenge for utilities wanting to scale reuse applications into operational, viable business opportunities. Pricing strategies need to account for a variety of factors, including type and location of offtakers, water quality, requirements, volumes, municipal wastewater parameters (e.g. organics), and necessary infrastructure (e.g., pipes, treatment).

For reuse to take on widespread adoption in Europe, there will need to be collaboration across stakeholders. Incentives for reuse will continue to come from EU levels of governance, although at a varied pace across the 27 countries. At a local and national level, technology vendors can also provide an impetus to changing mindsets and moving reuse forward. The drivers for change go beyond municipal utilities and governments. A notable shift towards corporate sustainability (i.e., ESG) is compelling companies to build out climate focused strategies, including more efficient water management and energy usage, to stave off rising costs, operational risks, and, in some cases, customer pushback.