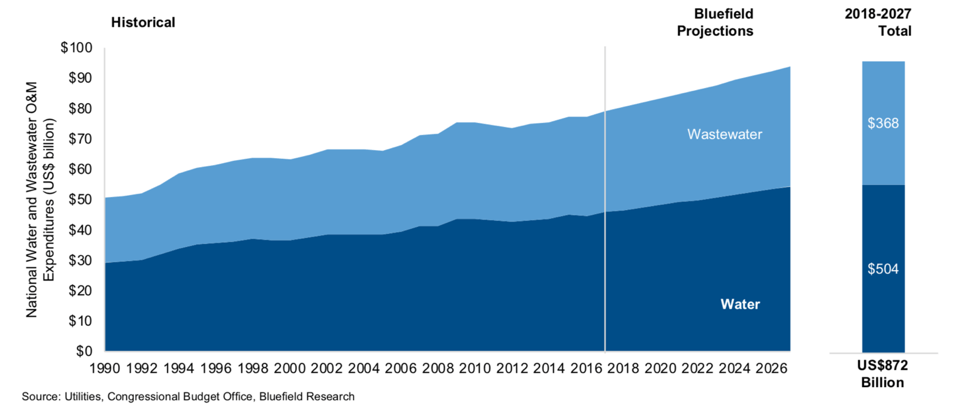

Boston, Massachusetts – Operating expenditures (OPEX) for water and wastewater utilities continue to climb at a steady clip, according to Bluefield Research’s recent 2018-2027 forecast. Over the last ten years, utilities’ OPEX has risen 15%, reaching the $79 billion in 2017. At this current pace, Bluefield Research forecasts the ten-year total to surpass $872 billion from 2018 to 2027, topping $93.8 billion by 2027.

Bluefield Research’s newly released report, U.S. Municipal Utility Operating Expenditure Forecast, 2018-2027, analyzes operating budgets of more than 70 water and wastewater utilities in all 50 states, over a three-year period.

“In a vacuum, these operating expenditures might be managed, but when accounting for rising capital expenditures, insufficient network replacement rates, and knowledge loss via staff turnover and retirement, water utilities’ operating costs are primed for more significant increases,” says Bluefield President Reese Tisdale. “While the annual growth in our reference case is 1.52%, we are seeing swings upward as high as 6.4%.”

Exhibit: Operating Expenditure Forecast by Segment, 1990-2027

Key takeaways from Bluefield’s OPEX Forecasts:

Utilities spend approximately US$296 annually per customer on water & wastewater system operations. The Western region’s average annual OPEX over the last three years was US$328 per customer, the only region above the national average. Detroit spends the most on a per customer basis for wastewater operating expenses at US$339 annually. On average, the utilities surveyed spent more on wastewater operations than water operations per customer.

Over the next decade, OPEX for water systems represent approximately 58% of total costs. Total OPEX for wastewater systems is expected to be 42%, or US$368 billion over the period.

Labor costs and depreciation combined make up over half of water utility operating expenses. Labor costs make up 28% of total operating expenses, while power costs– softened by low U.S. energy prices, make up 6% of total operating expenses. The largest piece of OPEX originates from third-party services and materials that are not broken out in utility budgets.

Low unemployment and an aging workforce within the utility sector, as a whole, are expected to increasingly squeeze utilities without adjustments. Rising OPEX across water and wastewater sectors reflects the need for utilities to embrace new technologies – such as digital water technologies and alternative business models, including those that promote resource recovery and related revenue generation.

“The divergence between OPEX and CAPEX trends are not sustainable, ” explains Bluefield Research Director Erin Bonney Casey. “Without increased investment in utility infrastructure, ongoing operating costs to maintain will begin outpacing historic trends, placing additional burden on ratepayers.”

About the Forecasts

Bluefield has analyzed water and wastewater utility budgets and annual reports in the U.S. to determine the historical trend and outlook for operating expenditures from 1990 through 2027. Bluefield addresses the expenditures by category– labor, power, materials, and depreciation– as detailed in the utility filings.

About Bluefield Research

Bluefield Research provides data, analysis and insights on global water markets. Executives rely on our water experts to validate their assumptions, address critical questions, and strengthen strategic planning processes. Bluefield works with key decision-makers at municipal utilities, engineering, procurement, & construction firms, technology and equipment suppliers, and investment firms.