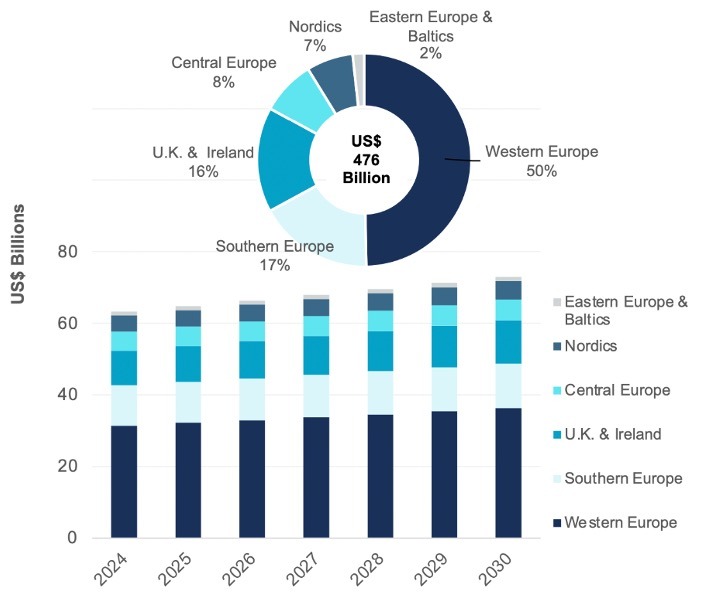

Barcelona, Spain, 14 February 2024: Europe’s water sector is pivoting toward a more sustainable, resilient future through national policy incentives, creative financing mechanisms, and digital technology advancements. Marked by strong regional differences, Bluefield Research forecasts a total of US$476 billion in water & wastewater infrastructure CAPEX from 2024 to 2030. According to a new report, Europe Municipal Water & Wastewater: CAPEX Market Forecasts, 2024–2030, the market is forecasted to scale 2% annually, from US$60 billion to approximately US$75 billion in 2030.

“Europe’s water market has long demonstrated stability; however, it now finds itself at a crossroads. Governments are now adopting more forward-thinking policies to address age-old water issues, such as population growth, drought, and leakage,” according to Zineb Moumen, Europe Water Market Analyst for Bluefield Research. “The European Green Deal, presented as the world’s first public, national commitment to climate neutrality, lays out a goal to achieve zero net greenhouse gas emissions by 2050. This will incentivize water utilities to invest in more efficient and sustainable operations,” says Moumen.

One key feature of the European Green Deal is the Urban Water and Wastewater Treatment Directive (UWWTD), which provides a core set of unified standards to manage and treat water resources. It will serve as the framework for more stringent regulations on water quality—including PFAS, emerging contaminants, and nitrogen levels in water. These policies will compel water and wastewater utilities to confront mounting economic, environmental, and regulatory challenges.

Water scarcity is posing significant risks to entire regions, with droughts extending well beyond the traditional summer period. Catalonia, Spain has implemented a Water Agency Drought Plan that reduces average consumption to 160 liters per inhabitant per day. The region also allocates €10 million (US$11 million) for drilling to find underground water and another €50 million (US$54 million) for infrastructure to enhance water supplies to avoid more extreme measures, such as water shipments. U.K. utilities, which are facing significant public and regulatory (i.e., Ofwat) pushback because of poor environmental performance and high leakage rates, have laid out investment plans focused on water security, leakage reduction, and improvements in wastewater management by 2030. “It is a critical time, as U.K. utilities are currently ramping up for the Asset Management Planning Cycle. AMP8, as it is termed, features an 86% increase from the last investment cycle, thereby doubling the utilities’ capital investments in the sector by 2025,” says Moumen.

Exhibit: Europe Water CAPEX Forecast by Region, 2024–2030

Source: Bluefield Research

Affordability, cost recovery, and funding for Europe’s utilities remain a key issue. Europe is unique in that funding for water infrastructure projects originates from multiple sources, including national budgets, the EU Cohesion Fund, and in some cases, private investors. While this hybrid funding model has improved the scale and speed of infrastructure development, a key challenge remains: Who will ‘pay the bill’?

“To achieve an effective financial structure, the water & wastewater sectors must find the right combination of revenues from water use, charges, tariffs, grants, fund mobilization, and private investments,” says Moumen.

The German government, in particular, has recognized the need for significant investments to support the modernization of the water sector and its adaptation to climate change. According to Bluefield’s analysis, Germany’s strategic plan includes 78 concrete measures that will be implemented through a mix of layered funding and regulations.

Eastern European countries, which have struggled with aging water infrastructure, are specifically targeting rehabilitation and replacement action plans. For example, Romania—where 30% of the population awaits connection to public water supply and 47% has yet to connect to a sewer network—must comply with a cascade of water quality, treatment, and management directives through the UWWTD. According to Bluefield’s analysis, Romania is among the top five fastest-growing European water markets, with €458 million (US$54 million) in CAPEX planned annually through 2030.

While major policy changes will take several years to work through member state legislation, water and wastewater system operators across Europe must continue to invest in the horizontal and vertical assets that form the backbone of the sector. From the election in June 2024, when members of the EU will vote for the European Parliament, to emerging PFAS regulations, these policies and initiatives will no doubt have major implications for water and wastewater management going forward,” says Moumen.

About this Report

Bluefield’s Insight Report provides a comprehensive overview of water investment drivers in Europe, analyzing the state of the market, technological advancements, regulatory frameworks, funding structures, and cost-recovery strategies. The forecasts highlight market opportunities by geography and asset segment by analyzing the national strategies and defined targets of various European countries. Access this report here. Bluefield’s corporate subscription clients also have access to the Europe CAPEX dashboard on Bluefield’s Data Navigator platform.