Last week, SMI’s 2019 Smart Water Systems conference in London showcased how far UK water utilities have come in adopting digital technologies – while making it clear how far they still have to go. The event offered a multi-stakeholder perspective on municipal water network management, innovation, and the future of the industry. While principally concerned with the UK market and the ongoing Price Review 2019, the organizers reached out to leading firms across Europe for best practices. In a season packed with conferences, this event stood out as a side current that offered useful reflection on where we are now, and where we might be going in the rush of new technology development. My take on the event boiled down in five key points:

A matter of meters. UK regulator Ofwat summarized its targets for the sector, including 15% leakage reduction and improved customer service. Metering customer consumption is a fundamental part of that, but 56% (!) of domestic properties go unmetered in the UK. Several metering OEMs were on hand looking for opportunities here, including Arad Group, Axioma, Diehl, Janz, Kamstrup, and Sensus. The pace of deployments is slowed by immature IoT solutions, an onerous customer authorization process, and unclear rates of return. To be viable in the UK, metering players must offer low cost, durable (15 year) concentric meters and help utilities navigate their data transmission challenges.

Source: Kamstrup

Forget Forecasting, how about Nowcasting. Both Consumer Council for Waterand ATI Technologies discussed (buzzword alert!) nowcasting. Nowcasting in this context referred to the optimization of situational awareness, such that utilities know in real time what is happening multidimensionally anywhere on their network (flow, temperature, pressure, pH, turbidity, time of last repair, etc). While many consumers just assume this is happening, the reality is quite different, as South East Water pointed out. Most UK operators have 1,000 – 2,000 customers in each district metering area (DMA) with a sensor at the water’s entry point into the DMA. But inside the DMA is a huge blind spot, due to the aforementioned lack of meters, or other sensors – which precludes more precise nowcasting. For there to be a step change in network management, distribution network visibility still requires significant investment in both instrumentation, and data analytics. But once this happens, utilities can see major room for improvement, as Portsmouth Water stressed the value of deploying Servelec loggers was being able to identify what they didn’tknow was going on. Nowcasting!

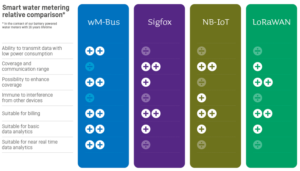

No clear telecoms path, but no excuse. The array of options for data transmission (Sigfox, NBIoT, Lora, etc) from RTUs, data loggers, meters continues to pose a difficult decision for utilities, as cited by several utilities trying to build a metering business case. The trade-offs were laid bare among the technologies in terms of coverage, signal strength, battery requirements, transmission frequency, data detail. But as the need to innovate weighs on network operators, they must hedge their bets with a mix of technologies deployed based on specific, sector-level use cases. Some metering firms (Kamstrup, Sensus) are going all-in trying to help utilities navigate the telecoms quandary, differentiating themselves from hardware-centric suppliers like Janz.

Not one capital, but six. South East Water framed investment decisions as a balance between rate of return, and the risk of inaction. Unfortunately, the incipient stage of digital water solutions’ deployment often means the business case is not so clear cut. Yorkshire Water applies the idea of Six Capitals to these decisions to capture longer term, multi-faceted value of projects. In the face of difficult-to-quantify risks associated with customer dissatisfaction, workforce development, and intellectual property based on inputs from pilot projects – six capitals may be a more realistic means of framing the quest for innovation.

Brexit or not, the flow must go on. Surprisingly little of the conference discussion addressed Brexit, as industry specialists focus on getting done the task at hand. Bluefield has looked at the market in the broader municipal context and sees significant pressure on utilities’ margins. On the sidelines, one EU-based manufacturer did mention an uptick in orders as utilities hurry to source equipment before import tariffs change. Another manufacturer pointed out that metering orders mean a steady flow of deliveries rather that spikes for major projects, creating a viable business case for the UK market if procurement increases in AMP7.

All in all, the conference captured some steady progress in terms of instrumentation on networks, rollouts of metering, and the possibilities more predictive data analytics can provide. Bluefield Research continues to track these efforts in detail. It’s now on utilities, and their technology partners, to deliver on their targets–and in the process they will push digital transformation of the sector much further along.

—–

Keith Hays is Vice President and Co-founder of Bluefield Research, a market research and insight firm focused exclusively on supporting companies addressing opportunities in water. Bluefield’s water experts analyze key trends, market shifts, and company strategies across the digital water landscape. Learn more at https://www.bluefieldresearch.com/digital-water/