Clients rely on our IOU M&A data to track deal flow for investor-owned utilities.

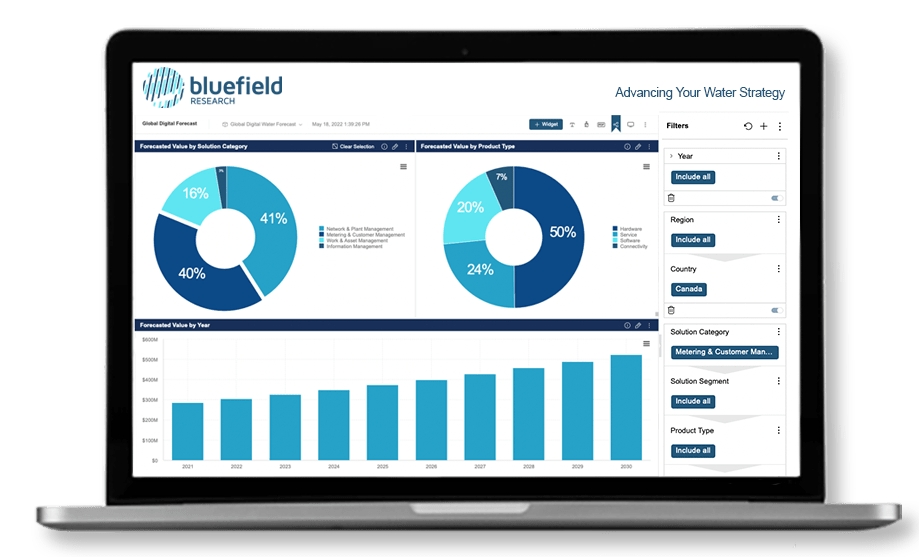

Our IOU M&A dataset offers a comprehensive look at at key trends, transactions, and competitive shifts in the U.S. private water market. The data goes back to 2015 and is updated quarterly. Our dashboard visualizes M&A activity over time, by state, and by company, including connection counts and purchase prices.

This data helps our clients address key questions:

- What were the biggest IOU M&A deals last quarter and how does this compare to previous years?

- Which states are seeing the most deal flow activity?

- Which utilities are growing through acquisition and where?

How do I access Bluefield’s IOU M&A data?

Client access to Bluefield’s Data Navigator platform is available with a Corporate Subscription for our Private Water service or our Water M&A service.

Can I download the raw IOU M&A data for myself?

Data Navigator seat holders can download the raw data in CSV format with the click of a button.

What information do you track for Water IOU M&A deals?

For each deal we track Buyer, Target Asset, Customer Connection Count and Total Announced Value. Across the deals we track Customer Connections, Connections by Buyer, Seller and Asset Type, Deals Approved by State and Average Approval Length.

How often is your water M&A deal data updated?

Our IOU M&A dashboard is updated on a quarterly basis along with our Private Water Quarterly Updates.

Become a Data Navigator Seat Holder

Worldwide Head of Development, AWS Water