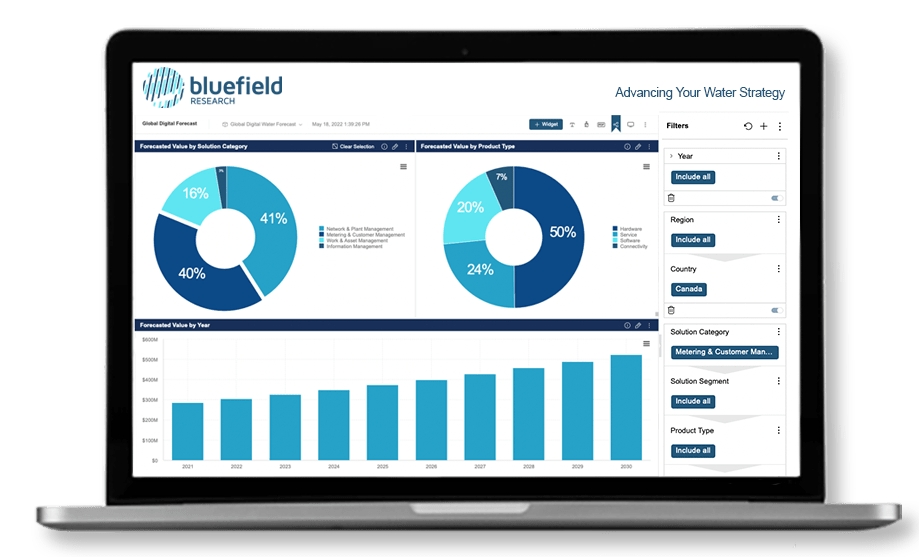

Clients rely on our funding analysis of digital water technologies and companies to identify growth opportunities.

As startups develop new solutions for a risk-averse water sector, venture capital (VC) is a key channel of funding to bridge a lengthy process in establishing key customer references and growth. Geographically, the U.S. dominates venture capital deal flow in water, but we are also seeing significant deal flow in the U.K., Canada and Australia.

Bluefield has tracked digital water deals from 2015 through the present. This data helps our clients address key questions:

- How does funding for digital water startups in 2023 compare to prior years?

- Which regions are seeing the most digital water investment?

- Who are the top 20 funded digital water companies?

- How does digital water funding break out between financial vs. strategic investors?

How do I access Bluefield’s Venture Capital Data?

Client access to our Venture Capital data is available through our Digital Water Corporate Subscription.

Can I download the raw data?

Yes. Clients can download the raw data of VC funding deals in Excel (CSV) with a click of a button.

How often is Bluefield’s Venture Capital data updated?

Our VC data is updated on a quarterly basis and highlights of this data are provided in our Quarterly Updates for Digital Water Corporate Subscription clients.

Become a Data Navigator Seat Holder

Worldwide Head of Development, AWS Water