29 January 2026, Barcelona, Spain – European utilities are embarking on a decade-long trajectory from monitoring to actively addressing per- and polyfluoroalkyl substances (PFAS) contamination in drinking water supplies. Enforcement of the EU Drinking Water Directive’s PFAS limits, which took effect 12 January 2026, now activates procurement requirements for treatment technologies across municipal water systems continent-wide.

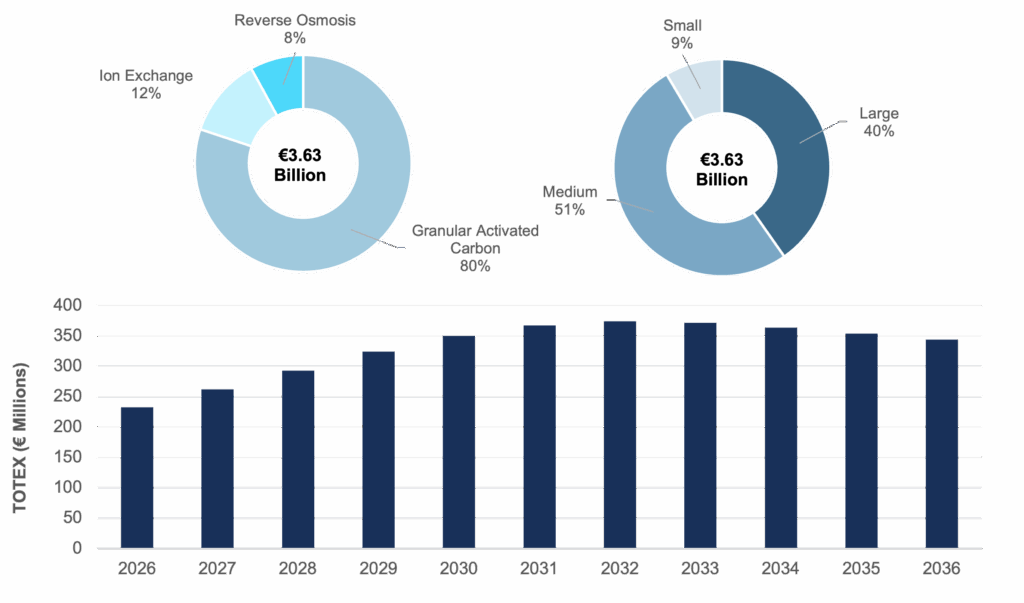

According to Bluefield Research’s new Insight Report, Europe PFAS Drinking Water: Regulation, Technology, and Market Forecasts, 2026–2036, total spending on PFAS treatment for drinking water across ten European countries is projected to reach €3.6 billion through 2036. Annual investment is anticipated to pick up after 2026, reflecting a three-to-five-year implementation lag driven by planning cycles, procurement timelines, and funding constraints.

Four countries—Germany, Italy, France, and Spain—are projected to account for roughly two-thirds of total PFAS drinking water treatment spending, reflecting their large installed treatment bases, stronger enforcement momentum, and greater exposure to legacy contamination risks. Germany leads at €1.1 billion, followed by Italy (€0.9 billion), France (€0.7 billion), and Spain (€0.4 billion). Outside these leading markets, adoption is expected to ramp up more gradually as smaller countries pursue regional compliance strategies, phased retrofit programs, and risk-based prioritization of higher-exposure supply zones.

Compliance Drives a First Wave of Investment

With binding PFAS limits now in effect under the revised EU Drinking Water Directive, utilities are expected to transition from assessment and monitoring toward treatment investment and implementation. For many municipal providers, this shift translates into accelerated capital planning, technology selection, and procurement activity for treatment facilities.

Utilities are under mounting pressure to demonstrate compliance while maintaining service continuity—particularly at medium and large facilities serving dense populations—driving demand for proven solutions that minimize operational disruption.

“Addressing PFAS is no longer an emerging issue in Europe; rather, now it is a compliance-driven investment,” says Zineb Moumen, an analyst at Bluefield Research. “The revised Drinking Water Directive turns PFAS limits into procurement action, forcing utilities to implement permanent treatment upgrades across their networks.”

Facing mandated timelines, utilities are prioritizing proven treatment approaches that can be rapidly deployed, retrofitted, and scaled with limited redesign of existing infrastructure. These dynamics favor granular activated carbon (GAC), which is expected to represent the lion’s share of early compliance activity—accounting for 80% of forecast spending through the first implementation phase—given its commercial maturity, operational familiarity, and fit for high-throughput drinking water systems.

Exhibit: Europe PFAS Drinking TOTEX Forecast by Technology and Plant Size, 2026–2036

Source: Bluefield Research

Beyond Quick Fixes: A Second Wave of Opportunity

While GAC systems will anchor early compliance, utilities will soon face more complex treatment and performance requirements.

“The initial wave gets utilities to the first goal, but the real challenge is what comes after,” Moumen explains. “With improved monitoring capabilities, potential expansion of PFAS contaminants, and tightened enforcement, treatment systems are likely to need more advanced technologies.”

This evolution is expected to unlock a second wave of investment focused on higher-selectivity technologies. Driven by long-term performance management needs, utilities will increasingly adopt selective resins, hybrid treatment trains, and destruction pathways designed to reduce residuals and long-term exposure. In this context, ion exchange and reverse osmosis are projected to represent 12% and 8% of total forecast expenditures, respectively.

The cost focus will also shift from capital expenditures to operating expenditures, making media replacement cycles, regeneration options, and residuals management critical to long-term economics. Suppliers that can reduce lifecycle cost—not just deliver compliance—will be best positioned for follow-on opportunities.

Integrated Platforms Become Strategic Differentiators

While the supplier landscape remains crowded in treatment materials, competitive advantage is increasingly shifting toward integrated compliance platforms. Utilities are placing greater value on partners that can deliver end-to-end execution—combining engineering and design, procurement support, construction and commissioning capabilities, operational expertise, and residuals management into a single accountable offering.

As adoption accelerates, the market is expected to consolidate around providers with platform-scale delivery. This shift is creating tailwinds for global water services and treatment leaders such as Veolia and SUEZ, alongside specialists that pair treatment media with lifecycle services—such as Calgon Carbon (Kuraray) in activated carbon and Purolite (Ecolab) in ion exchange.

“The shift from reactive compliance projects to sustained operational discipline will define the next phase of Europe’s PFAS drinking water treatment market,” says Moumen. “This is where compliance becomes strategy—and where early adopters can turn near-term urgency into long-term resilience.”

About Bluefield Research

Bluefield Research supports strategic decision-makers with actionable water market intelligence and data in the global municipal and industrial sectors. With expertise spanning infrastructure, policy, and technology, Bluefield helps companies understand where the market is going—and why.

The Insight Report titled Europe PFAS Drinking Water: Regulation, Technology, and Market Forecasts, 2026–2036 presents an in-depth assessment of PFAS compliance across Europe, including market size, regulatory analysis, technology deployment pathways, competitive dynamics, and investment white space. The full report is available for purchase and can be downloaded immediately from Bluefield’s website.