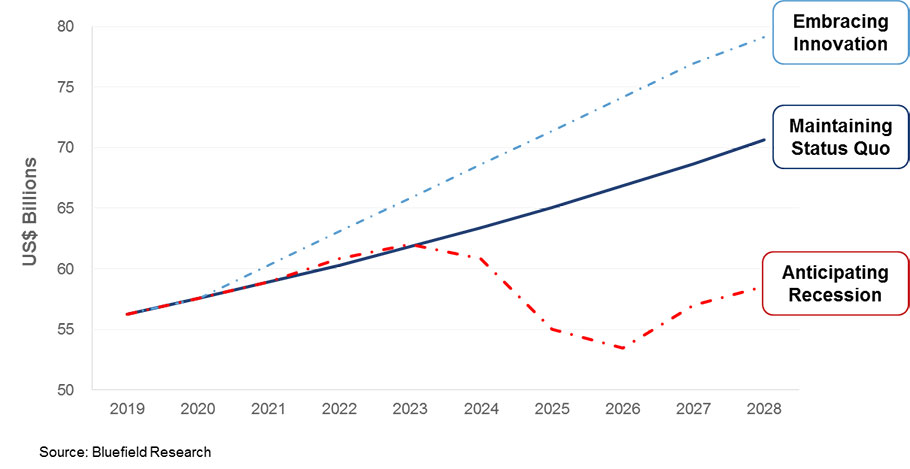

Municipal utilities in the United States are expected to deploy US$629 billion on capital expenditures (CAPEX) over the next decade to address increasing demands on water and wastewater infrastructure, according to a new report. While authors from Bluefield Research baseline forecast project a 2.6% annual growth rate, and expectedly in-line with historical trends, their scenario analyses highlight an altogether different picture, including a potential US$107 billion swing over the 10-year forecast period that signals additional financial, operational, and management risks for water and wastewater utilities.

Even in a mature water infrastructure sector, signals are pointing towards a crossroads.

Segmenting Utility CAPEX: U.S. Municipal Water Infrastructure Forecast, 2019-2028, details municipal utility CAPEX in 50 states, five U.S. territories, and Washington, D.C. The analysis also breaks down the forecasted spending across 21 categories (e.g. plants, pipes, pumping stations, valves) that represent the lion’s share of infrastructure investment. These insights, drawing from Bluefield’s separate analysis of hundreds of capital improvement plans (CIP) and their categorization into 60+ expenditure buckets, are proving to be valuable tools for vendors’ addressable market analysis and peer utility benchmarking.

The myriad of challenges—many of which are not well quantified, including the deterioration of existing assets, changing demographic and industrial demands, and environmental stresses—is growing at a pace unforeseen decades ago. As such, the status quo is quickly fading as an option, if it has not already, to adequately treat, distribute, and collect water and wastewater, and maintain existing assets with traditional financing and technology solutions.

The Maintaining Status Quo scenario forecasts a CAPEX split between water and wastewater to be US$270 billion and US$359 billion, respectively. Within this broader spend, treatment assets (e.g. plants, systems) for both sectors combined make up 52%, or US$325 billion, of the total and pipe collection and distribution spend makes up another US$185.8 billion, or 29.5%. The remainder is spread across other smaller segments, including pump and lift stations, storage tanks, and associated network hardware (e.g. manholes, valves, hydrants, and pipe fittings).

However, a recent acceleration of concerns about water quality (e.g. lead, PFAS, algae blooms) will present increasing financial and operational risks to municipal utility stakeholders. From community leaders to customers, greater public awareness and heightened public expectations from infrastructure service providers will necessitate significant investment in advanced treatment—as opposed to linear pipe networks—as demonstrated in Bluefield Research’s Embracing Innovation scenario.

Even in a mature water infrastructure sector, signals are pointing towards a crossroads. Further erosion of customer confidence in water supplies, however, should compel regulators to drive greater innovation and CAPEX on advanced treatment.

More likely than any significant regulatory shift—beyond incremental policy changes at the state level—an economic recession would have a wider, sweeping impact on utility CAPEX and management decisions. This does not even account for the customer-side impacts on utility revenues and OPEX. By accounting for historical impacts, including financial stimulus, Bluefield’s Anticipating Recession scenario could result in a 7.8% CAPEX decline over the next ten years. Similar to historic downturns, the impact on utility CAPEX, decision-making, and workforce will lag several years behind the rest of the economic cycle.

More optimistically… solutions to these scenarios exist, whether they be financial or technological. Unfortunately, many of these opportunities lie across the value chain but are often hidden by the noise of inertia, culture, and political whims. Before hitting the crossroads, vendors and utilities need to think more strategically to better identify and understand their addressable markets, vendor offerings, and market outlook.