Last week, from 4-6 September, Bluefield Research attended Aquatech Mexico 2018, the leading water industry event for Latin America’s second largest market. Pessimism and inertia in the municipal segment were offset by a steady drumbeat of business for industrial water, presenting a market with sizeable investment opportunities, albeit not easily accessible. Our takeaways:

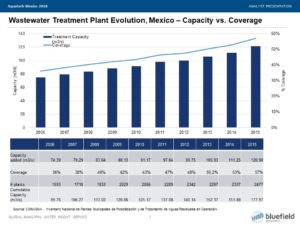

Municipal water – Business as usual during transition year. For the municipal water market, several policies and projects await instruction from the incoming Lopez Obrador administration after June elections. Beyond the 12 water and sanitation projects Banobras promotes in its Mexico Projects hub platform, details of a new infrastructure plan are sparse with ongoing skepticism following the cuts to the outgoing administration’s 2014 plan. Nationally, Mexico’s municipal water and sanitation indicators remain stubbornly static at 75% potable water supply network coverage in rural areas, 40% national average leakage rates, and 57% treatment of wastewater.

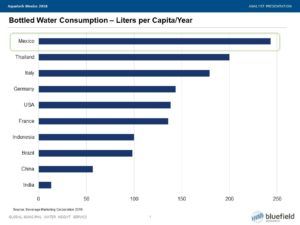

Challenges in the municipal segment stem from a lack of local water utility cost recovery based on a combination of political/economic/cultural factors that show few signs of change. Lack of public trust in municipal water makes Mexico the world’s largest market for bottled drinking water per capita, with all the added cost and environmental impact that entails. Like other emerging water infrastructure markets, many Mexican municipalities continue trapped in the vicious circle of underinvestment that results in poor service, limited tariff collection, lack of revenue for improvement, which perpetuates underinvestment. How can Mexico break the cycle? The answer seems to rely heavily on private sector participation.

Mexican PPPs – few but functional. Bluefield presented in a session highlighting success stories in municipal wastewater infrastructure that detailed projects in Guadalajara and San Luis Potosí. Both cases illustrated certain states’ ability to enable projects for wastewater treatment and reuse through a winning combination of financial, technical, and regulatory planning efforts. Three-tiered tariff structures with guaranteed demand, transparently executed tendering processes, federal grants to lower up-front costs, and well-designed risk allocation brought these projects to fruition despite the dozens of others that fail to de-risk investment. Going forward, a renewed effort to emulate and capitalize on these successes will be a key input to Mexico’s new water infrastructure development plan going beyond 2017 announcements under its current PPP plan.

Scarcity-driven industrial demand anchors Mexican water market. Specific industrial verticals (petrochemical, power generation, mining, beverage, paper) anchor demand for equipment and services driven by water scarcity rather than regulatory compliance. Most states lack stringent, high level enforcement of effluent regulation that would drive greater investment in wastewater treatment solutions. But industries continually suffer from low quality municipal water for production processes (e.g. boiler feed for gas power plants), and a lack of supply security due to overdraft of aquifers and/or surface water. This scarcity concern drives investment in municipal wastewater reuse (costing 40-60% less than municipal potable water tariffs), zero liquid discharge projects at factories, and small-scale desalination plants. Many purveyors of treatment solutions for desalination and effluent reuse populated AquaTech Mexico’s exhibition floor focused on these drivers of industrial demand.

Mexico digital water solutions adoption: first industrial, while municipal requires further definition. Bluefield offered an overview of key trends emanating from Europe and the US concerning smart water solutions. Wracked with challenges to meet basic infrastructural requirements, in general municipal water utilities remain a tough sell for digital water solutions despite longer term OPEX and CAPEX savings. Although privatized systems elsewhere in Latin America have begun to deploy advanced metering, real time leak detection and pressure management (such as ESSBÍO Chile, AEGEA Brasil), Mexico does not host the same set of regulatory and financial drivers to enable adoption of these technologies (SWAN Forum offers a unique hub for Mexican utilities to find applicable best practices). Bluefield anticipates smart water solutions will first grow the most in Mexico via industrial condition monitoring applications such as real-time management of process water use at petrochemical production facilities, boiler-feed monitoring at power production plants, or tailings dam monitoring at mining sites. Adoption of technologies for these types of assets will also hinge on scarcity and commodities prices.

Despite all its challenges, the sheer size of the Mexican market, and its significance for the broader region, position the country as a key target for rollout of a host of water and wastewater solutions and services. Bluefield will continue to track firms’ progress and project references through its Global Municipal Water Insight, Global Industrial Water Insight, and Digital Water Insight services.