19 February 2026, Boston, Massachusetts – The artificial intelligence (AI)-driven data center boom is fundamentally transforming the U.S. water landscape. Surging electricity demand is driving this change, shifting water risks upstream to power generation and impacting communities that never anticipated becoming ground zero for AI infrastructure.

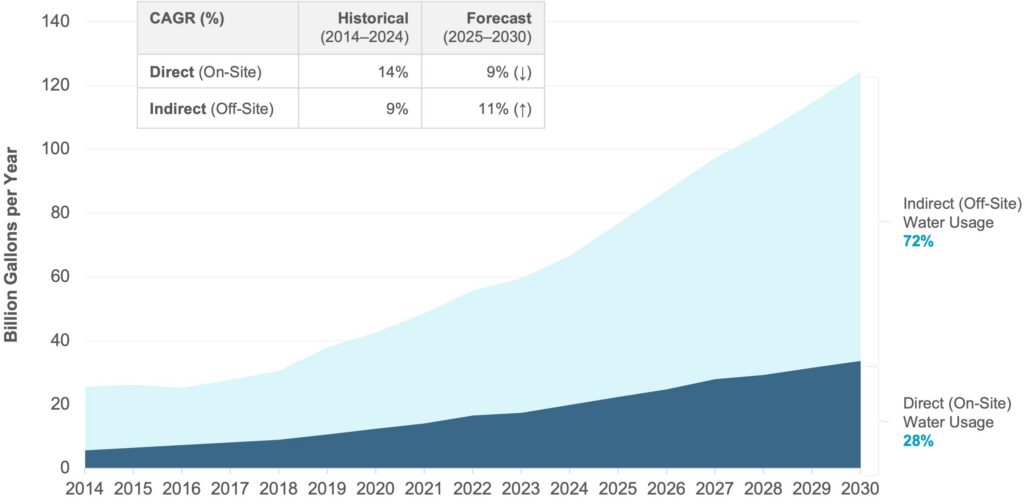

A new Insight Report titled The Water-Power Nexus: How Data Centers are Reshaping the U.S. Water Landscape, published by Bluefield Research, reveals that the biggest water story in AI infrastructure is not happening on-site within data center facilities—it is occurring at electric power plants. By 2030, 72% of total water consumption associated with data centers will occur off-site and be tied to electricity generation—more than double the forecasted on-site cooling demands. Data centers are expected to account for 8.9% of the total U.S. electricity demand by the end of the decade, up from 4.4% in 2023.

“While data centers use water directly for on-site cooling, the rapid growth in electricity demand is driving up the sector’s overall water use outlook,” says Amber Walsh, research director at Bluefield Research. “Power—not on-site cooling—is becoming the defining water risk for the data center industry.”

Exhibit: Data Center Water Consumption Footprint, 2014–2030

Note: Indirect water consumption based on the moderate data center power outlook

Source: U.S. Energy Information Administration, U.S. Department of Energy, Bluefield Research

Power Becomes Primary Source of Water Exposure for Data Centers

Indirect water consumption linked to electricity generation is expected to nearly double, increasing from 54 billion gallons in 2025 to 91 billion gallons by 2030. This uptick is driven by the brutal reality of how power companies are scrambling to meet a 12% surge in electricity demand. Near-term strategies such as delaying coal plant retirements, recommissioning nuclear facilities, and fast-tracking natural gas build-out carry significant water costs with long tails.

In sharp contrast, on-site water consumption for data center cooling is decelerating as operators transition to more efficient cooling methods and reclaimed water sources. This on-site consumption is projected to grow modestly from 22 billion gallons to 34 billion gallons over the same period. “The water story has moved upstream, and it’s not coming back,” says Walsh. “Unlike the installed base of data centers, AI gigafactories and hyperscale campuses are being designed from the ground up with closed-loop cooling, advanced liquid cooling at the chip level, and reclaimed water integration.”

Geographic Concentration Intensifies Regional Water Challenges

The surge in AI data centers is coalescing in a handful of states, shaped by incentives, available land, and existing infrastructure capacity. Texas, Virginia, and Pennsylvania represent more than US$360 billion in planned investments, and growth is expanding further into the water-stressed Sun Belt region, where power availability is attracting investment and local water infrastructure is inadequate. This mismatch is particularly noticeable in Arizona, where high water stress coincides with explosive data center build-out. In cities like Phoenix, Arizona; Atlanta, Georgia; and Columbus, Ohio, developers are being compelled to adopt reclaimed water and advanced cooling methods quickly.

Hyperscale Facilities and AI Gigafactories Reshape Industry Dynamics

The scale of AI infrastructure is redefining what constitutes water risk. Hyperscale and AI-focused facilities currently account for 46% of total data center electricity demand, and this share is rapidly increasing. Microsoft’s power consumption grew at a compound annual growth rate of 30% from 2020 to 2023. Google’s indirect water footprint from power generation alone exceeded an estimated 5 billion gallons in 2024, representing 43% of its total water usage.

A new category of facilities is raising the stakes further. AI gigafactories—built solely for AI with capacities exceeding one gigawatt—have a staggering water footprint driven almost entirely by power demand rather than on-site cooling. While Meta, Google, and Microsoft are procuring renewable energy to offset carbon exposure, this strategy does little to alleviate immediate water pressures on the grid.

“We’re at an inflection point, and the decisions being made today about where to site gigafactories and how to power them will shape U.S. water availability for decades to come,” says Walsh. “Increasingly, water access has become a critical lever, alongside electricity prices, that communities and local governments are wielding to set the terms of engagement with data center developers.”

About Bluefield Research

Bluefield Research supports strategic decision-makers with actionable water market intelligence and data in the global municipal and industrial sectors. With expertise spanning infrastructure, policy, and technology, Bluefield helps companies understand where the market is going—and why.

The Insight Report, The Water-Power Nexus: How Data Centers are Reshaping the U.S. Water Landscape, analyzes how the electricity demand generated by data centers affects water use across the U.S. thermoelectric generation fleet. The full report is available for purchase and can be downloaded immediately from Bluefield’s website.