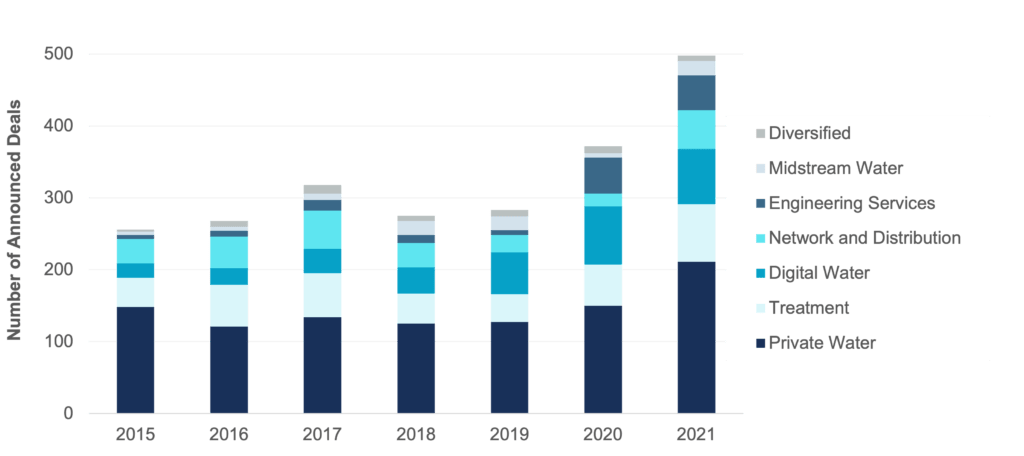

28 March 2022, Boston, Massachusetts: Water-related M&A surged in 2021, far outpacing the prior year, as measured by the number of water transactions and disclosed deal values, according to water market intelligence firm, Bluefield Research. At 498 announced deals, a 34% increase over 2020, scaling confidence in water-related solutions and strategies to address water quality concerns, climate-related risks, and failing critical infrastructure is being manifested through company acquisitions.

Punctuating the year-end transaction total, the combined transaction sum for deals with disclosed values grew to US$80 billion, up from US$35 billion in 2020, and the number of deals exceeded the annual average of 298. Bluefield’s quarterly review of water sector M&A, now exceeding 2,300 deals since the start of 2015, tracks the buyers and sellers across six key segments: Digital Technology, Treatment, Midstream Water (i.e., oil & gas), Engineering Services, Network & Distribution (e.g., hardware and equipment), and Private Water (i.e., utilities).

“Behind this jump is a convergence of critical factors shaping opportunities in water that include a mounting focus on ESG and corporate sustainability, federal infrastructure legislation, such as the Infrastructure Investment and Jobs Act, and available capital for investment,” says Reese Tisdale, President & CEO of Bluefield Research. “It is also worth noting that strategic and financial investors are increasingly aggressive in their approaches to water M&A, thereby driving up competition and values.”

While deal flow has been robust across all segments, the biggest increases have been in the Private Water and Network & Distribution segments, in which year-end transaction totals exceeded the prior year by 58 and 36 deals, respectively. These two segments make up 57% of the 2021 total and highlight anticipated growth opportunities to address utility operations and aging infrastructure. The Treatment and Digital Water segments make up 17% and 15%, respectively, and point to the growing focus on water quality and trends toward smarter, digitally connected assets.

Exhibit: Market Pulse – Water M&A Activity by Year

Source: Bluefield Research

By year-end 2021, Bluefield identified 13 water-related transactions each topping US$1 billion, compared to only three in 2020. Three notable, billion-dollar “water pure-play” deals kicked off the year. Autodesk made a long-anticipated acquisition of private equity-backed, digital solutions player Innovyze for US$1 billion. Quikrete purchased ductile iron pipes and precast concrete supplier Forterra, Inc. for US$2.74 billion; and New Mountain Capital acquired Aegion Corporation for US$963 million in the wake of acquiring a leading contract operations service provider, Inframark.

“For us, the Autodesk deal is particularly interesting and indicative of a potential wave of Big Tech firms targeting water as an opportunity,” says Tisdale. “As enterprise software companies, cloud services providers, and electronics manufacturers build out water-focused strategies, including M&A, solutions for utilities, industrials, and homeowners are expected to become more advanced. This includes companies like Autodesk, Amazon, and Samsung, among others.”

Instead of water just representing part of the deal, investors are now going after water specifically as the opportunity. This is bringing increased interest from private equity companies and financial investors. Companies like Warren Equity Partners, which has made seven digital water acquisitions since 2016, New Mountain Capital, and Middleground Capital are expected to continue expanding their newfound water footprints.

The strong deal flow activity is underpinned by the more than 210 utility and asset acquisitions, mostly in the U.S., where small systems represent the lion’s share, or 78%, of utility deal flow of the segment total. The utility segment’s fragmentation, financial stresses, and favorable policy environment for acquisitions, is also ushering in a shift in the competitive landscape, including a growing presence of firms such as NextEra Water, NW Natural, Liberty Utilities, and Central States Water Resources.

Overall, Bluefield expects global water M&A activity to remain robust, supported by strong market tailwinds, though high company valuations in key strategic sectors (e.g., digital water), geopolitical concerns, and inflation loom large enough to pose a potential cooling effect on the market. Until then, however, market watchers will remain on the lookout for any platform deal opportunities, including collateral divestments from the recent Suez-Veolia acquisition and EQT’s sale of French water management firm, Saur.