This policy brief is for Global Water Corporate Subscription clients.

Overview

The ESRS provide reporting parameters for the environmental, social, and governance (ESG) issues identified in the Corporate Sustainability Reporting Directive (CSRD). Reporting is mandatory and will affect more than 50,000 large and listed companies (with some exceptions for listed micro-enterprises) operating in the European Union.

In alignment with the European Green Deal and other standardized international regulations, the ESRS require that companies disclose the perceived risks and opportunities associated with how their activities impact people and the environment. ESG ratings are increasingly relevant to investors and consumers examining corporate accountability and holistic risk management strategies. CSRD noncompliance could lead to financial sanctions and exclusion from investor portfolios.

A shift in focus toward environmental standards for water and marine resources (ESRS-E3) is particularly relevant for investors and companies active in the water sector or heavily reliant on this resource. It also broadens the market for water solution providers, as it promotes optimization and reuse processes. As corporations seek to reduce their water footprint and exposure to risks, new business opportunities will arise.

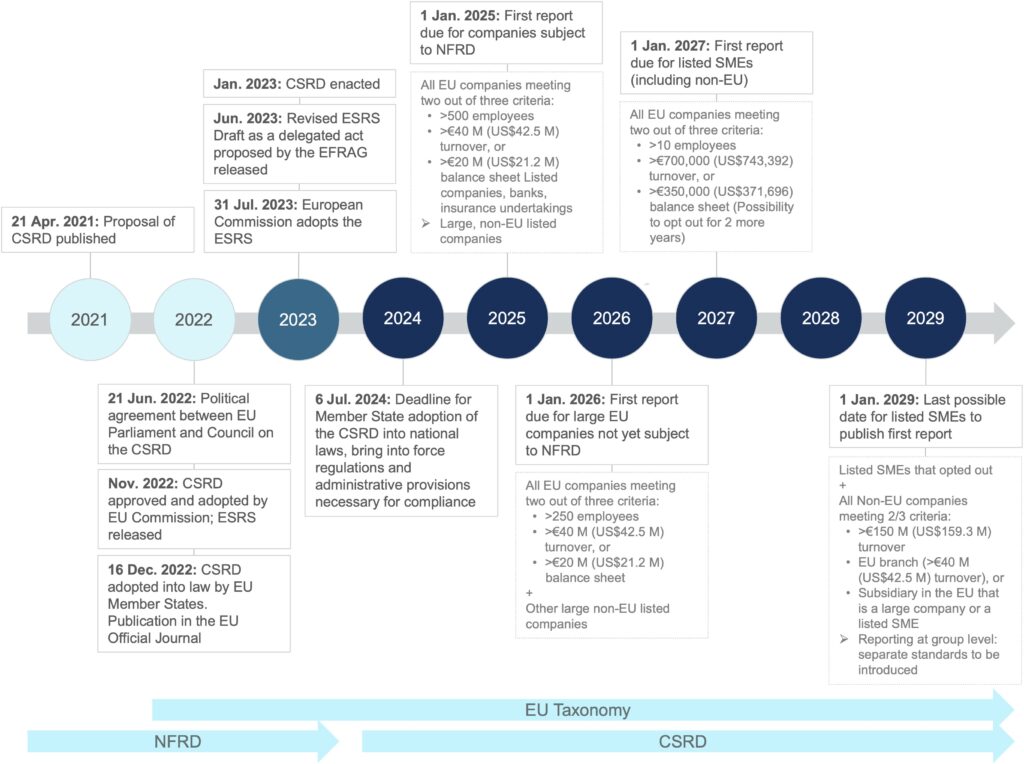

Currently in the early stages of adoption, ESRS reporting will be phased in for larger companies over time. Beginning in 2024, the standards will apply to companies employing more than 500 staff members, with the adoption period for smaller companies extending until 2028.

History

On 5 January 2023, the European Union enacted the Corporate Sustainability Reporting Directive (CSRD). Adopted by the European Commission in November 2022, the directive mandates large and listed companies within the EU to report on several ESG indicators. It seeks to standardize sustainability reporting; enhance the quality and reliability of the reported data; and encourage companies to identify and address sustainability impacts, risks, and opportunities within their business plans and risk management strategies.

The CSRD is an expansion of the reporting requirements from the previous Non-Financial Reporting Directive (NFRD). The new CSRD ruling applies to approximately 50,000 companies—a significant increase from the 11,700 companies mandated to report under the NFRD. The rules introduced by the NFRD remain in force until companies are required to apply the new rules of the CSRD.

On 31 July 2023, the European Commission adopted the ESRS as a part of the European Green Deal (the EU’s roadmap for becoming a climate-neutral economy by 2050). Based on technical input from the European Financial Reporting Advisory Group (EFRAG) and consultations with Member States and various EU bodies, the ESRS offer accurate, consistent, and comparable reporting on the CSRD by using a common framework structure throughout the EU.

Regulatory Landscape

In compliance with the CSRD, the ESRS formalize sustainability reporting and require companies to outline their plans to improve ESG performance. The broadened scope of companies included in the ESRS signals another step toward greater visibility into the environmental risks (including water-related issues) of larger firms listed in the EU.

EFRAG worked to enhance interoperability between ESG reporting structures such as the International Sustainability Standards Board (ISSB), the Global Reporting Initiative (GRI), and the Task Force on Climate-Related Financial Disclosures (TCFD) recommendations. These are different, voluntary, internationally recognized ESG reporting frameworks.

The EU’s CSRD is unique in its undertaking of environmental reporting, as it has integrated ISSB standards into its legal framework and established a mandatory baseline for ESG reporting. Noncompliance could lead to financial sanctions and exclusion from investor portfolios. Moreover, the ESRS apply to all member countries without requiring them to be implemented into national law (unlike the CSRD). Companies can omit some metrics, targets, policies, and actions outside the mandatory, general disclosures—subject to the conclusions of a double materiality assessment. This unburdens enterprises from reporting on activities that are insignificant or do not have enough weight vis-à-vis ESG reporting under the ESRS. Unless properly justified, it may also hurt their ranking with regard to investor portfolios and financial support.

The areas covered under the environmental set of ESRS pertain to the following areas: climate, pollution, water and marine resources, biodiversity and ecosystems, and resource use and circular economy. The topics covered range from the more traditional measurement of a company’s greenhouse gas emissions to the use of recycled materials and environmental mitigation strategies.

Focus on Water and Marine Resources (ESRS-E3, or E3):

Most interestingly, the ESRS incorporate issues specific to water and marine resources under ESRS-E3 with new standards to measure water performance:

The first three standards cover disclosure requirements for policies, targets, action plans, and resources directly relevant to water and marine resource-related impacts , risks, and opportunities (IROs); the number of targets adopted to address these IROs; and action plans and resources allocated to the implementation of these plans.

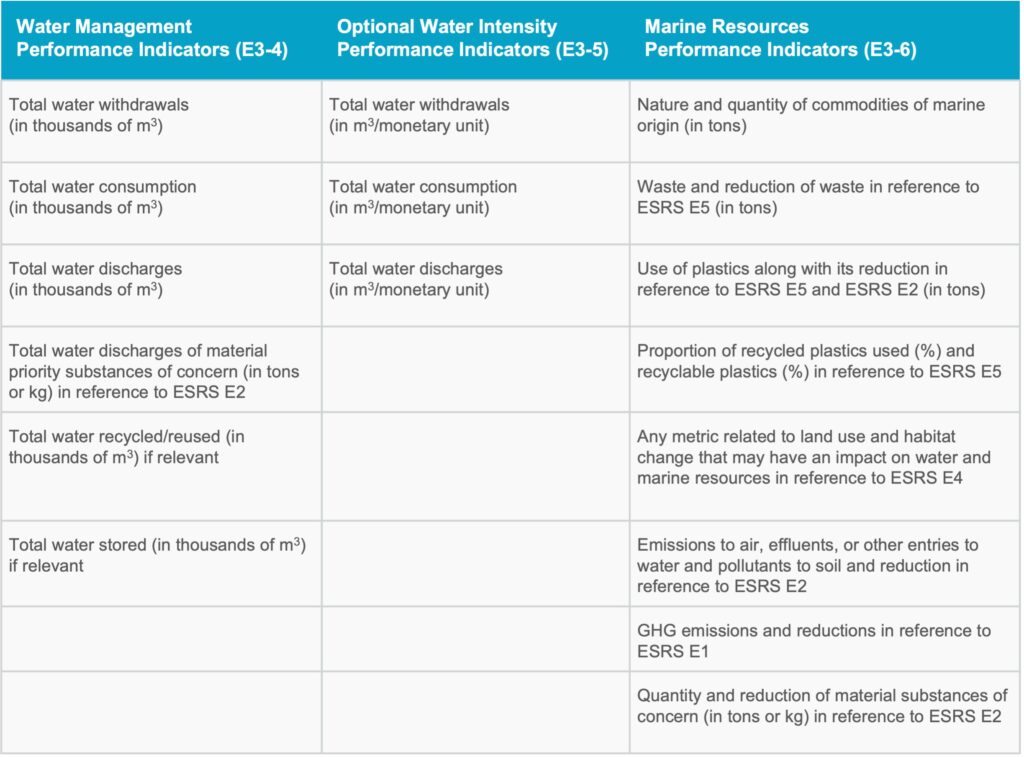

Next, for the first time, the CSRD incorporates measurable targets, mandatory water performance management indicators, and optional water-intensive performance indicators:

Exhibit: Performance Indicators

Source: EFRAG, Bluefield Research

Finally, E3-7 covers disclosure requirements on potential financial effects of material risks and opportunities from water and marine resources-related impacts and dependencies.

Market Effect – Who Does It Impact?

The ESRS will apply to approximately 50,000 businesses operating in the EU. Companies will disclose mandatory and voluntary data points related to water and marine KPIs, which impact industries like agriculture, energy, and manufacturing the most.

Reporting will be phased in over time for different companies, starting in 2024 with companies employing over 500 staff members. All listed small and medium-sized enterprises (SMEs) will need to log internal performance by 2026. Phase-in provisions offer more flexibility for SMEs to decide what is relevant to report in their context; smaller companies can postpone reporting by up to two years, depending on the topic.

Listed SMEs that are not required to report on their performance until 2027 may report on separate, less demanding, and proportionate standards still under draft by the EFRAG. Non-listed SMEs may also report on simpler voluntary standards, currently under draft as well.

Exhibit: EU CSRD Timeline under the ESRS

Source: Denkstatt, European Commission, Eco Cost Value, Bluefield Research

ESRS-E3 is particularly relevant for companies active in the water sector or heavily reliant on water to develop their economic activities. It opens business opportunities for water service and water technology providers specializing in water optimization, monitoring, and reuse processes. Corporations with a presence in the EU will seek to reduce their water footprint and exposure to water risks to improve their ESG rating and expand their funding and business opportunities in the EU.

The European Commission has asked EFRAG to prepare additional guidance for reporting entities. Lastly, EFRAG is currently developing drafts for SMEs and standards for non-EU companies, as well as sector-specific standards from the following sectors:

- Oil and gas

- Coal, quarries, and mining

- Road Transport

- Agriculture, farming, and fisheries

- Motor vehicles

- Energy production and utilities

- Food and beverages

- Textiles, accessories, footwear, and jewelry

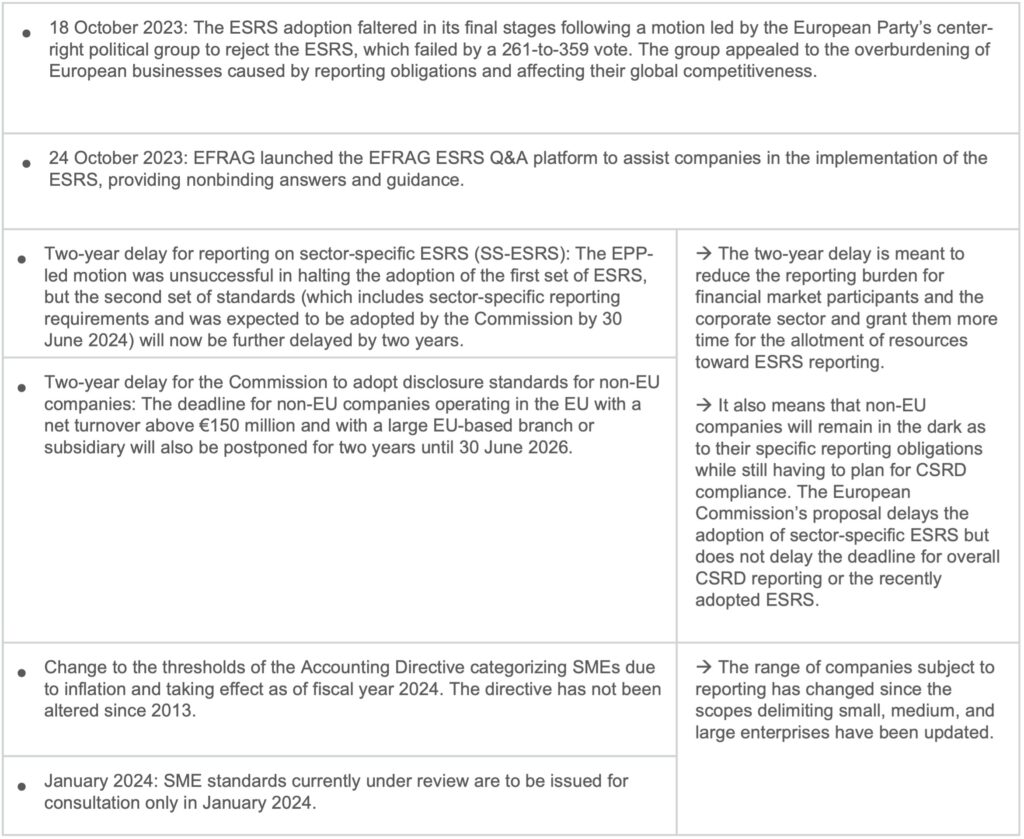

Latest Updates:

Source: Anthesis, European Commission, Lexology, Bluefield Research

Criticisms around the ESRS

Although the EU claims that the ESRS’ minimum requirements and similarity to other international sustainability reporting standards help companies comply with the CSRD, the interoperability between ISSB and ESRS is not exact. Adapting reporting data points to comply with alternate definitions of closely related terms will generate reporting inconsistencies and fatigue. International, EU-listed companies will still report using other worldwide-recognized frameworks as global businesses.

By setting out a common ESG disclosure framework, financial market participants can filter and identify data points to understand the sustainability impact and performance of their investments. Nevertheless, due to the financial incentives linked to complying with the ESRS, there is a higher risk of greenwashing—while at the same time, many disclosure requirements that are voluntary or subject to materiality assessments will remain underreported.

Conversely, the granularity within the ESRS and the limited guidance provided by EFRAG overburdens less mature, inexperienced SMEs. Internal knowledge building, data monitoring, and strategic planning capabilities take time to develop and will require the employment of external environmental consultancy services.