Every year on March 22, the United Nations takes stock of the world’s availability and use of water. For 2014, the focus of World Water Day is water and energy, which are inextricably linked. The United Nations wants to address the water-energy nexus for the more than 1 billion people who live without reliable access to either resource.

“With the best technologies and water and energy resources available, there is still the possibility of matching demands in a sustainable way,” the U.N. wrote in a statement, “although this will need some radical changes in the institutions and incentives to manage water and energy.”

As in other years, the statistics sketching the scope of the problem seem only to grow more staggering, while comprehensive solutions for all of the world’s water challenges have not yet been developed.

Energy production accounts for about 15 percent of the world’s total water use, a proportion that could increase by about 20 percent by 2035.

Despite the huge growth in renewable energy, it still pales in comparison to the existing and new fossil fuel power plants coming on-line. Developing nations will need more than $100 billion to finance water delivery and wastewater treatment in the next year alone.

By 2030, 75 percent of the increase in energy resources is expected to come from fossil fuels, according to the U.N. Water treatment and delivery also require a great deal of energy, and these sectors have been slow to adopt efficiency measures.

Desalination processes are one solution for countries that lack ready access to fresh water, but the technology is relatively expensive. There are various startups and incumbents that are developing technologies to make desalination more energy-efficient and affordable. Last week, LG Chem bought California-based startup NanoH2O for $200 million for its membrane technology for desalination.

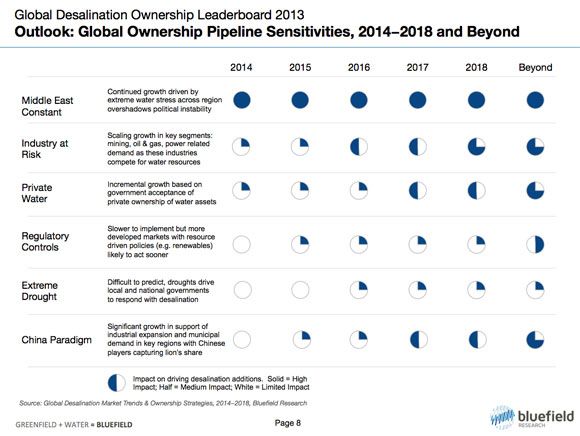

With record droughts in Brazil, California and Southeast Asia, cutting-edge technology for water could see more investment, but only if the price of water rises in most areas of the globe. Factors such as China's growth and increased activity in energy industries could be some of the most significant drivers of desalination technology in coming years, according to Bluefield Research.

Although the investment growth is likely to continue to be incremental, “more companies are interested in the water sector,” said Reese Tisdale, president of Bluefield Research. “Asian companies are also taking a bigger stake.”

The U.N. has called for transparency in water and energy pricing in terms of long-term sustainability, along with fiscal incentives for water and energy efficiency technologies. Despite the occasional large-scale investments in new water technologies, such as the recent example of NanoH2O's acquisition, investment in water has not yet come close to matching the scale of the problem.

Similar calls to action are made every year on World Water Day, and yet the bleak figures measuring the water intensity of human activities show no sign of improvement.